NOTE: VIDEO AT THE END OF THE ARTICLE

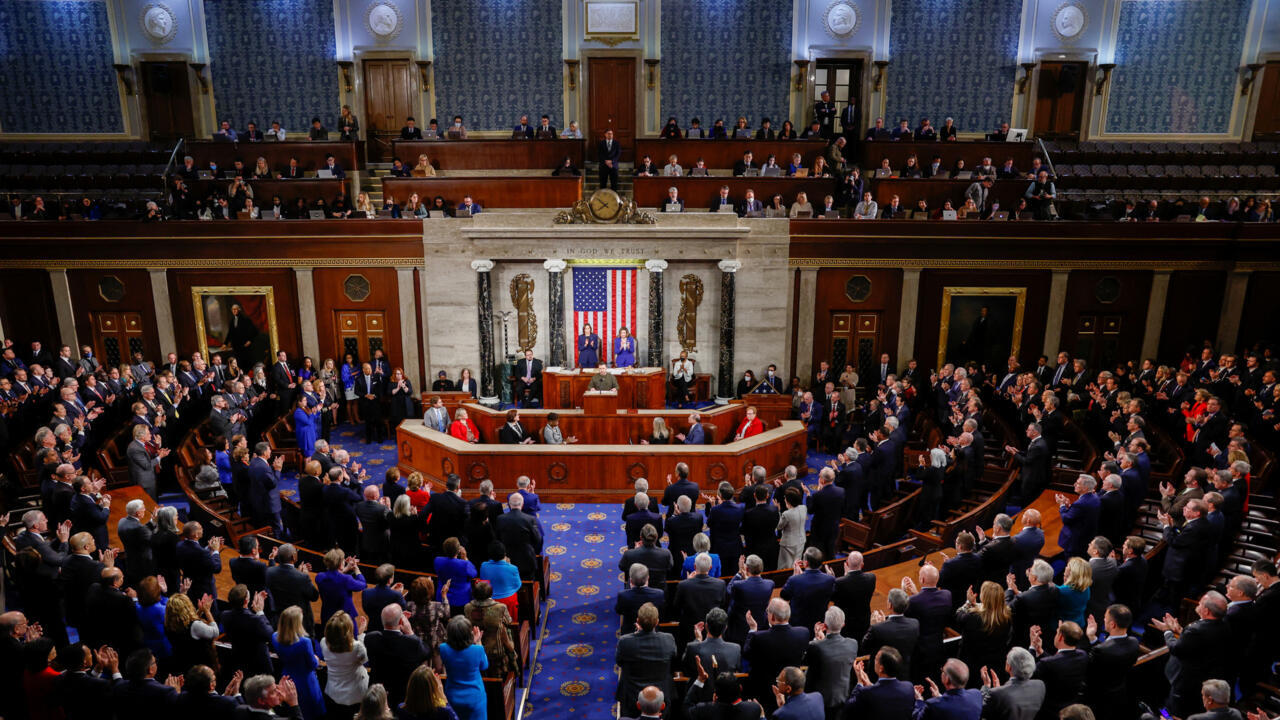

In a moment that caught much of the tech and finance world off guard, the U.S. Senate quietly moved forward with a sweeping piece of legislation that could have massive ripple effects across the digital economy.

After months of behind-the-scenes discussions, political maneuvering, and intense lobbying, lawmakers came together in rare bipartisan fashion to pass a controversial bill that touches on the future of money itself. Supporters are calling it a long-overdue step toward clarity, while critics warn it could open the floodgates to both innovation and risk.

The vote, which passed with strong support from both major parties, wasn’t just symbolic—it marked the beginning of a new chapter for how America handles one of its most fast-moving and disruptive technologies. For an industry that has operated for years in a legal gray zone, the shift toward federal oversight is being seen as both a challenge and an opportunity.

Proponents argue that the legislation introduces much-needed rules and accountability to a space long criticized for its lack of transparency. The bill lays out new standards for who can operate in the space, how financial reserves must be managed, and how companies will be audited and monitored. In essence, it sets the first real guardrails for a market that has until now largely governed itself.

Opponents, however, are sounding alarms. Some lawmakers, particularly from the progressive wing, have expressed deep concern about potential loopholes and national security implications. One high-profile senator went so far as to say that the bill could undermine financial stability and consumer protections while enabling politically connected players to dominate the sector.

What’s particularly striking about this development is the speed at which things are now moving. With the bill headed to the House of Representatives—where support is expected to be even stronger—final approval could come within weeks. If signed into law by the president, it would mark one of the most consequential regulatory actions taken in the financial space in over a decade.

Industry leaders are watching closely. Some have praised the bill for finally giving them a clear rulebook, while others worry it could push smaller innovators out of the market altogether. One thing is certain: the era of operating without oversight is ending.

The implications of this vote go far beyond Washington. They touch on the very foundation of how value moves in the modern world—and what role the U.S. will play in shaping that future.

PLAY:

https://www.youtube.com/watch?v=W_nqyZqiP5M

James Jenkins is a celebrated Pulitzer Prize-winning author whose work has reshaped the way readers think about social justice and human rights in America. Raised in Atlanta, Georgia, James grew up in a community that instilled in him both resilience and a strong sense of responsibility toward others. After studying political science and creative writing at Howard University, he worked as a journalist covering civil rights issues before dedicating himself fully to fiction. His novels are known for their sharp, empathetic portraits of marginalized communities and for weaving personal stories with broader political realities. Jenkins’s breakout novel, Shadows of Freedom, won national acclaim for its unflinching look at systemic inequality, while his more recent works explore themes of identity, resilience, and the fight for dignity in the face of oppression. Beyond his novels, James is an active public speaker, lecturing at universities and participating in nonprofit initiatives that support literacy and community empowerment. He believes that storytelling is a way to preserve history and inspire change. When not writing, James enjoys jazz music, mentoring young writers, and traveling with his family to explore cultures and stories around the world.