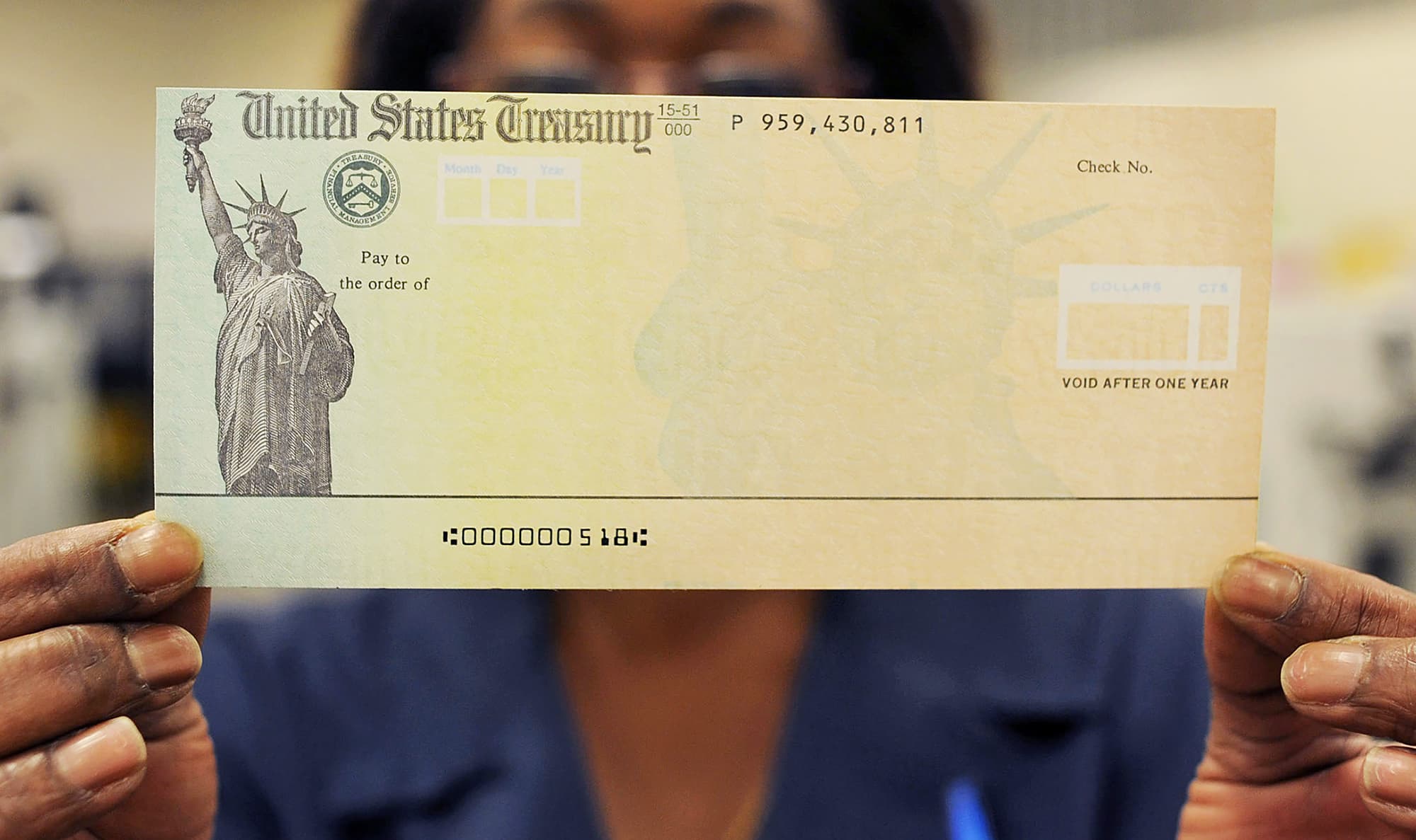

A senior White House economic official says the likelihood of Americans receiving $2,000 rebate checks funded by tariff revenue has increased significantly, pointing to stronger economic growth and improving federal balance sheets as reasons the idea is gaining traction inside the administration.

Kevin Hassett, director of the National Economic Council, said in a recent interview that conditions have shifted enough for the proposal to be considered viable, after months of internal debate about whether the federal government could afford such payments without worsening the nation’s debt outlook.

Earlier this year, Hassett expressed uncertainty about whether the economy could support broad rebate checks. That view, he said, has changed.

During an appearance on CBS’s Face the Nation on December 21, Hassett said that improved fiscal indicators have created room for the White House to move forward with a formal proposal.

“In the summer, I wasn’t so sure that there was space for a check like that,” he said. “But now I’m pretty sure that there is.”

Hassett cited sustained economic growth and reductions in government debt relative to projections as the primary drivers behind the shift. He added that the White House expects to present a proposal to Congress in the coming year, emphasizing that legislative approval would be required before any checks could be issued.

While the concept of rebate checks funded by tariff revenue has circulated publicly for months, Hassett’s remarks marked one of the clearest signals yet that the administration intends to pursue the idea in earnest.

Tariff Revenue and Fiscal Calculations

The proposed rebates would be funded primarily through revenue generated by tariffs imposed during the Trump administration’s trade actions. Officials have argued that those tariffs have produced substantial income for the federal government while also reshaping trade relationships with major economic partners.

According to administration officials, tariff collections have exceeded earlier expectations, contributing to stronger-than-forecast revenue flows. Combined with economic growth that has outpaced prior estimates, the White House believes it may be able to distribute rebate payments without significantly worsening long-term debt projections.

Still, Hassett stressed that the plan remains subject to congressional approval and ongoing legal uncertainty surrounding the tariffs themselves.

“And so I would expect that in the new year, the president will bring forth a proposal to Congress to make that happen,” Hassett said. “Congress ultimately decides how to appropriate those funds.”

Within Congress, the idea has drawn mixed reactions. Some lawmakers view rebate checks as a way to return tariff revenue directly to American households, particularly those facing higher costs due to trade policies. Others argue that the funds should instead be used to reduce the national debt or shore up federal programs.

Several Republicans have already voiced skepticism, warning that direct payments could undermine fiscal discipline or contribute to inflationary pressures if not carefully designed.

Legal Uncertainty Surrounding Tariffs

Complicating the issue is an ongoing legal challenge to the tariffs themselves. The Supreme Court is currently weighing whether the administration’s use of the International Emergency Economic Powers Act of 1977 to impose certain tariffs was lawful.

Two lower courts have previously ruled against the administration’s approach, raising questions about whether some tariffs could ultimately be overturned.

Hassett acknowledged that an adverse Supreme Court ruling could create administrative challenges but said he does not expect the Court to order widespread refunds of tariff revenue.

“We really expect the Supreme Court is going to find with us,” Hassett said. “But even if they don’t, it’s unlikely they would call for massive refunds because of how administratively complex that would be.”

He explained that tariffs are typically paid by importers rather than consumers directly, meaning any refund process would require importers to allocate returned funds across supply chains—a task he described as highly impractical.

“The people who pay the tariff are usually the importers,” Hassett said. “If there were refunds, those entities would be responsible for distributing them appropriately, which becomes very complicated.”

Because of that complexity, administration officials believe the Court would be reluctant to mandate large-scale repayments even if it rules against the tariffs’ legal foundation.

Alternative Paths for Tariff Authority

Officials have also suggested that the administration has alternative mechanisms available should the Supreme Court limit the current tariff framework.

Treasury Secretary Scott Bessent has said in recent interviews that countries facing higher tariffs should expect them to remain in place, particularly if they have not complied with previous trade commitments. He added that nations that negotiated agreements with the United States are expected to honor those deals regardless of how the Court rules.

In a December 7 social media post, President Donald Trump defended the administration’s current tariff authority, calling it “more direct, less cumbersome, and much faster” than other trade enforcement tools. He also indicated that the White House has additional options available if legal challenges require adjustments.

Those statements suggest that tariff policy—and any revenue derived from it—will remain a central feature of the administration’s economic strategy going forward.

Who Would Receive the Checks

While details of the rebate proposal have not been finalized, officials have indicated that the payments would likely be targeted toward low- and middle-income Americans rather than distributed universally.

Treasury Secretary Bessent has previously said that income thresholds would likely apply, with higher-income households excluded from the program. Hassett echoed that view, noting that lawmakers would ultimately determine eligibility criteria through the legislative process.

The potential checks have drawn comparisons to past stimulus payments, though administration officials have emphasized that tariff-funded rebates would differ in both purpose and design.

Unlike pandemic-era stimulus checks, which were funded through deficit spending, the proposed rebates would rely on existing revenue streams, a distinction the White House believes could make the plan more politically and fiscally palatable.

Inflation and Political Concerns

Despite the administration’s confidence, some economists and lawmakers remain wary. Critics argue that injecting billions of dollars into the economy through rebate checks could risk reigniting inflation, particularly if consumer demand accelerates too quickly.

Others question whether tariff revenue is stable enough to support recurring payments, especially given ongoing legal uncertainty and shifting global trade dynamics.

Supporters counter that current economic conditions are far different from those that fueled inflation earlier in the decade, pointing to easing price pressures and improved supply chains.

Hassett suggested that the administration is closely monitoring inflation indicators and would not move forward with a proposal it believed could destabilize prices.

Looking Ahead to 2026

If the proposal advances, it would likely become part of a broader economic debate heading into the 2026 election cycle, with implications for trade policy, fiscal responsibility, and household finances.

For now, the White House appears focused on laying the groundwork rather than rushing a decision. Hassett emphasized that no checks can be issued without congressional approval and that discussions remain ongoing.

Still, his remarks signal a notable shift from earlier caution to growing confidence within the administration that rebate checks could become a reality.

As legal questions work their way through the courts and lawmakers debate how best to use tariff revenue, the prospect of $2,000 checks remains uncertain—but no longer theoretical.

For millions of Americans, the coming year may determine whether tariff policy translates into direct financial relief, or whether those funds are ultimately directed elsewhere.

Emily Johnson is a critically acclaimed essayist and novelist known for her thought-provoking works centered on feminism, women’s rights, and modern relationships. Born and raised in Portland, Oregon, Emily grew up with a deep love of books, often spending her afternoons at her local library. She went on to study literature and gender studies at UCLA, where she became deeply involved in activism and began publishing essays in campus journals. Her debut essay collection, Voices Unbound, struck a chord with readers nationwide for its fearless exploration of gender dynamics, identity, and the challenges faced by women in contemporary society. Emily later transitioned into fiction, writing novels that balance compelling storytelling with social commentary. Her protagonists are often strong, multidimensional women navigating love, ambition, and the struggles of everyday life, making her a favorite among readers who crave authentic, relatable narratives. Critics praise her ability to merge personal intimacy with universal themes. Off the page, Emily is an advocate for women in publishing, leading workshops that encourage young female writers to embrace their voices. She lives in Seattle with her partner and two rescue cats, where she continues to write, teach, and inspire a new generation of storytellers.