In a dramatic and highly scrutinized turn of events, a second federal grand jury in Virginia has declined to indict New York Attorney General Letitia James on mortgage-fraud allegations, sources told ABC News. The decision—delivered only days after another grand jury in Norfolk rejected the same set of charges—marks an extraordinary setback for the Department of Justice (DOJ) and raises pressing questions about both the origins and the viability of the case federal prosecutors attempted to build against one of the nation’s highest-profile state attorneys general.

The failed effort to secure an indictment comes on the heels of a federal judge’s dismissal of an earlier case against James, a ruling that rested on what the court determined to be the unlawful appointment of the U.S. attorney overseeing the Eastern District of Virginia. Following that decision, DOJ prosecutors attempted to revive the case by bringing it before a new grand jury, this time in the Alexandria division of the district. But according to multiple sources, the grand jury flatly rejected the DOJ’s arguments, declining to approve charges that alleged James misled a financial institution during the process of obtaining a mortgage.

A Rare Double Rejection

In federal criminal practice, grand juries are often described as having a broad mandate and typically approve indictments in the overwhelming majority of cases presented to them. Against that backdrop, back-to-back rejections in two separate cities—Norfolk and Alexandria—represent a remarkable and unusual rebuke of the prosecution’s theory of the case.

According to sources familiar with the proceedings, prosecutors argued that James had misrepresented the status of a property she purchased in 2020 by categorizing it as a second home rather than an investment property. That distinction can be financially significant: borrowers who list a property as a second home rather than a rental investment can qualify for more favorable mortgage terms. In this instance, prosecutors alleged that the difference could have amounted to as much as $19,000 in savings over the life of the loan.

However, despite the DOJ’s push to bring the case anew, grand jurors remained unconvinced. The Alexandria panel reportedly rejected the proposed indictment after hearing the evidence, mirroring the earlier decision out of Norfolk just the week prior. Without the support of a grand jury, federal prosecutors cannot pursue the charges.

A Justice Department spokesperson did not immediately respond to requests for comment, leaving the reasoning behind their persistence—and their position following the latest rejection—unclear.

Defense: “A Mockery of Our System of Justice”

James’ attorney, Abbe Lowell, responded forcefully to the grand jury’s decision, describing the case as fatally flawed from its inception. In a statement, Lowell said, “This unprecedented rejection makes even clearer that this case should never have seen the light of day. Career prosecutors who knew better refused to bring it, and now two different grand juries in two different cities have refused to allow these baseless charges to be brought. Any further attempt to revive these discredited charges would be a mockery of our system of justice.”

Lowell’s remarks highlight what many legal analysts view as one of the most striking aspects of the case: according to ABC News, some federal career prosecutors assigned to review the matter early on reportedly had concerns about the strength of the evidence. Those concerns appear to have centered on how much—if at all—James personally profited from the loan terms and whether the alleged misrepresentation amounted to a prosecutable fraud offense.

The defense has long insisted that James acted lawfully during the purchase of the property and that the underlying allegations stem from misinterpretations or exaggerations of routine mortgage documentation. James herself has consistently denied all wrongdoing.

Context: The Political Landscape

Letitia James has been a prominent national figure, particularly since leading a successful civil fraud case against now-President Donald Trump in 2024. That case, which resulted in significant financial penalties and widespread media attention, elevated James’ national profile and made her a prominent political figure—admired by many Democrats and sharply criticized by many Republicans.

Because of this context, news of a federal investigation into James attracted immediate political attention. Some critics of the attorney general suggested that the probe demonstrated hypocrisy on her part, while supporters cast the investigation as a politically motivated retaliation against a Democrat who had aggressively pursued legal action against Trump.

The DOJ has not commented publicly on the political climate surrounding the case, and there is no publicly available evidence indicating political influence over the investigation. Nevertheless, the optics of the situation have contributed to public scrutiny, particularly now that two grand juries have declined to indict.

Why the Grand Jury Decisions Matter

Grand jury decisions are not public, and the detailed reasoning behind them is rarely known. However, the fact that two separate panels—composed of ordinary citizens—independently refused to authorize charges provides a powerful indication that prosecutors may not have met the threshold of probable cause required to bring a case.

That threshold is significantly lower than the “beyond a reasonable doubt” standard required for conviction, meaning that grand jury rejections often signal deep skepticism about the legal or factual grounding of the allegations.

Legal experts note that while prosecutors are not prohibited from presenting the case to a third grand jury, doing so would be highly unusual. The DOJ must weigh not only the likelihood of securing an indictment but also the broader implications—legal, political, and institutional—of continuing to pursue a case that has now been twice rejected.

Questions About the Case’s Foundations

ABC News previously reported that the internal DOJ investigation uncovered evidence that appeared to undermine aspects of the September indictment initially filed before the judge dismissed the case. This included uncertainty regarding the actual financial benefit James might have obtained through the alleged misrepresentation. If James did not substantially profit from the loan terms—or if the alleged incorrect classification resulted from clerical or lender-side actions rather than deliberate deception—then the legal basis for fraud charges becomes more tenuous.

Fraud cases often require establishing intent: prosecutors must demonstrate that the defendant knowingly and willfully made false statements for the purpose of obtaining something of value. If investigators uncovered evidence suggesting that James relied on lender guidance or that the loan classification had minimal financial impact, the burden of proof becomes far more difficult to meet.

What Comes Next

With two grand jury rejections and the original indictment already dismissed in court, the future of the mortgage-fraud allegations appears uncertain at best. Legal analysts say the DOJ now faces three options:

-

Drop the case entirely and acknowledge that the evidence does not support prosecution.

-

Attempt to refile the case before yet another grand jury—an approach that could expose the department to criticism of forum-shopping or prosecutorial overreach.

-

Conduct additional investigation, though the public reporting suggests that investigators may already have exhausted the relevant avenues.

For James, the decisions represent a significant vindication in a legal saga that has loomed over her office for months. But the broader political and institutional questions raised by the failed prosecutions—about the DOJ’s judgment, the handling of politically sensitive cases, and the mechanisms for oversight of federal prosecutors—may continue to resonate.

As of now, James remains focused on her duties as New York’s attorney general. She has maintained that the allegations against her were unfounded and politically charged, and the twin grand jury refusals will likely bolster that narrative.

This remains a developing story, and additional information may emerge as more details about the internal DOJ deliberations come to light. For now, though, the unprecedented double rejection marks a major pause—and possibly an end—in the federal government’s pursuit of mortgage-fraud charges against one of the country’s most influential state law-enforcement officials.

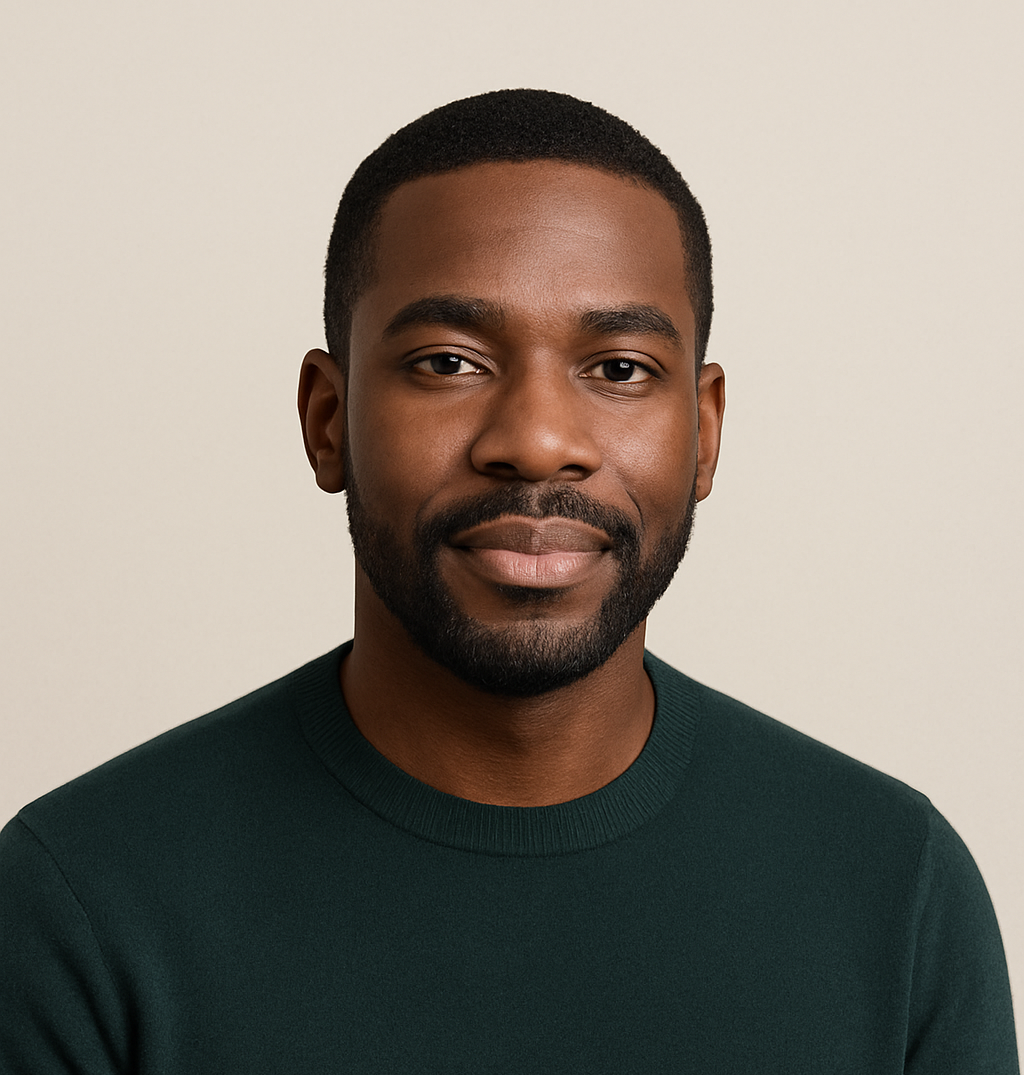

James Jenkins is a celebrated Pulitzer Prize-winning author whose work has reshaped the way readers think about social justice and human rights in America. Raised in Atlanta, Georgia, James grew up in a community that instilled in him both resilience and a strong sense of responsibility toward others. After studying political science and creative writing at Howard University, he worked as a journalist covering civil rights issues before dedicating himself fully to fiction. His novels are known for their sharp, empathetic portraits of marginalized communities and for weaving personal stories with broader political realities. Jenkins’s breakout novel, Shadows of Freedom, won national acclaim for its unflinching look at systemic inequality, while his more recent works explore themes of identity, resilience, and the fight for dignity in the face of oppression. Beyond his novels, James is an active public speaker, lecturing at universities and participating in nonprofit initiatives that support literacy and community empowerment. He believes that storytelling is a way to preserve history and inspire change. When not writing, James enjoys jazz music, mentoring young writers, and traveling with his family to explore cultures and stories around the world.