A Head Start on the New Year for Millions of Americans

As the year draws to a close, millions of Americans who rely on Social Security benefits will notice something different in their bank accounts. For some recipients, payments that would normally arrive in early January will instead be deposited on New Year’s Eve, offering a financial head start as 2026 begins.

The change is not the result of a new policy or emergency action, but rather a routine adjustment tied to the federal holiday calendar. Still, for retirees, disabled Americans, and low-income households living on fixed incomes, even small timing changes can make a meaningful difference—especially during a season already strained by higher living costs.

Why Payments Are Moving to December 31

Social Security payments are distributed according to a structured monthly schedule. Most beneficiaries receive payments based on their birth dates, while others—particularly those receiving Supplemental Security Income—are paid at the beginning of each month.

Because January 1 is a federal holiday, payments that would normally be issued that day must be sent on the preceding business day. This year, that date falls on Wednesday, December 31.

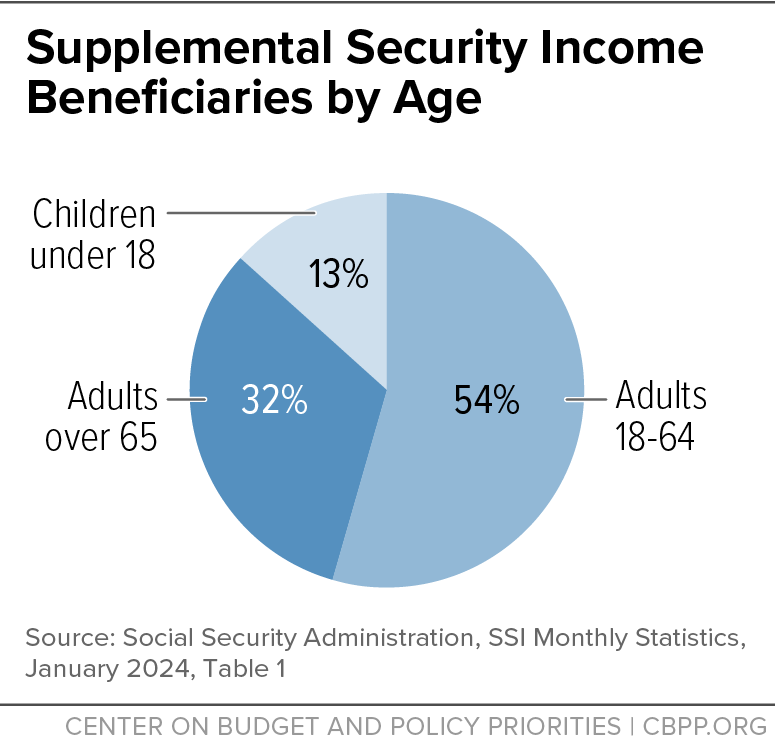

This adjustment primarily affects recipients of Supplemental Security Income (SSI), which is designed for seniors and disabled individuals with limited income or financial resources. Instead of receiving their January payment on New Year’s Day, eligible recipients will see the funds arrive one day earlier.

How the Social Security Payment Schedule Works

To understand who is affected, it helps to know how Social Security payments are typically distributed.

Most Social Security retirement and disability benefits are paid on the second, third, or fourth Wednesday of the month, depending on the beneficiary’s date of birth. However, SSI payments are normally sent on the first day of the month, unless that day falls on a weekend or federal holiday.

There is also a separate group of recipients who receive benefits on the 3rd of each month. This includes:

In January 2026, the 3rd falls on a Saturday, meaning those beneficiaries will instead receive their payments on Friday, January 2.

A Modest but Meaningful Boost for 2026

Beyond the calendar shift, beneficiaries will also notice a change in the amount of their payments. Beginning with January deposits, Social Security benefits will reflect the 2026 cost-of-living adjustment (COLA).

For 2026, the adjustment is set at 2.8 percent, intended to help benefits keep pace with inflation. While the increase may appear modest on paper, it applies broadly across the system—impacting approximately 71 million Social Security recipients and 7.5 million SSI beneficiaries nationwide.

The COLA is calculated using changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a long-standing measure used to track inflation affecting household expenses.

What the Increase Means for Households

For retirees and disabled Americans living on fixed incomes, even small increases can help offset rising costs for essentials such as groceries, utilities, rent, and medical care.

While the adjustment may not fully counteract inflation pressures felt over the past several years, it does provide incremental relief—particularly for those with little flexibility in their monthly budgets.

Importantly, the COLA applies automatically. Beneficiaries do not need to take any action to receive the increase, and it will be reflected in payments beginning in January.

Improvements Inside the Social Security System

Behind the scenes, the Social Security Administration has also reported progress in improving service delivery and reducing long-standing delays.

According to agency leadership, wait times on the national customer service hotline have dropped significantly compared to previous years. Average wait times, which exceeded 25 minutes in 2024, were reduced to roughly 15 minutes in 2025, with some months seeing even faster response times.

These improvements came despite a substantial increase in call volume. Officials attribute the gains to expanded self-service options, improved callback systems, and upgraded internal technology that allows claims to be processed more efficiently.

Faster In-Person Service and Online Access

In-person visits to Social Security field offices have also become more efficient. Average wait times have fallen, particularly for individuals who schedule appointments in advance.

The agency has also invested in modernizing its online systems, reducing scheduled downtime and allowing beneficiaries to access accounts, documents, and benefit information around the clock.

These changes have been especially important for seniors and disabled individuals who may face mobility challenges or rely on caregivers to manage their benefits.

Progress on Disability Claim Backlogs

One of the most persistent challenges for the Social Security system has been the backlog of disability claims. In recent years, long processing times left applicants waiting months—or even years—for decisions.

In 2025, the agency reported measurable progress, reducing the disability claim backlog by hundreds of thousands of cases and shortening average wait times by several weeks. While delays still exist, officials say the trend is moving in the right direction.

What Beneficiaries Should Do Now

For most recipients, no action is required. Payments will be issued automatically according to the adjusted schedule, and the COLA increase will appear without additional paperwork.

However, beneficiaries are encouraged to:

-

Monitor bank accounts closely around the end of December

-

Budget carefully, remembering that the December 31 payment is January’s benefit, not an extra check

-

Be cautious of scams, especially around holidays, involving fake messages about benefit changes

Anyone with questions can contact the Social Security Administration directly through official channels.

Looking Ahead to 2026

As 2026 begins, the combination of early payments and a modest benefit increase offers a small measure of stability for millions of Americans who depend on Social Security.

While challenges remain—from inflation to long-term funding concerns—the adjusted payment schedule and system improvements underscore the role Social Security continues to play as a financial backbone for retirees, disabled individuals, and low-income households nationwide.

For those receiving payments on New Year’s Eve, the early deposit serves as a practical reminder: even small calendar shifts can have real-world impact when every dollar counts.