Former Speaker’s Fortune Soars Over Decades in Office

New data has reignited debate over financial transparency in Congress after reports showed former House Speaker Nancy Pelosi’s wealth has grown exponentially during her decades in office.

According to a detailed review of Pelosi’s financial disclosures by the Daily Caller News Foundation, the California Democrat’s net worth increased by at least 2,292% between 1987, when she first entered Congress, and 2024. Her reported assets rose from a minimum of $2.6 million to nearly $64 million, with some independent analyses — such as Quiver Quantitative — estimating her current net worth at around $278 million.

The figures have fueled growing scrutiny of how lawmakers manage their investments and whether sitting members of Congress should be allowed to trade stocks at all while in office.

A Record of Financial Success and Growing Public Skepticism

At 85 years old, Pelosi remains one of the wealthiest and most influential Democrats in Washington. Her 2024 filings show a maximum estimated net worth exceeding $311 million, a sum that significantly outpaces the median household wealth in her San Francisco district.

Analysts also noted that Pelosi’s investment portfolio outperformed the S&P 500 last year, nearly doubling the market’s overall growth rate. That success has prompted critics to question whether congressional access to sensitive policy information could give lawmakers — or their families — an advantage in financial markets.

Pelosi’s office, however, has strongly denied any misconduct. A spokesperson stated that the congresswoman “does not personally own or manage stocks” and that “all investment decisions are made independently by her husband, Paul Pelosi.”

Still, the perception of potential conflicts of interest continues to haunt lawmakers from both parties, prompting bipartisan calls for stricter trading regulations.

Support Builds for Ban on Congressional Stock Trading

In recent months, Pelosi herself has voiced support for legislation that would bar members of Congress — along with presidents and vice presidents — from trading individual stocks while in office.

“We must have strong transparency, robust accountability, and tough enforcement for financial conduct in office,” Pelosi said during a July press conference. “The American people deserve confidence that their elected leaders are serving the public interest — not their personal portfolios.”

The proposed legislation, which gained momentum after being advanced by the Senate Homeland Security and Governmental Affairs Committee, reflects growing public frustration over congressional trading practices.

Trump and Critics Reignite Accusations of Insider Advantage

Former President Donald Trump has repeatedly accused Pelosi of benefiting from insider information during her tenure. In comments made to Breitbart News in 2022, Trump called her stock trading activity “not right” and “not fair to the rest of this country.”

“She has inside information,” Trump said. “It’s not appropriate, and it shouldn’t be allowed. She’s clever, but she’s also stone-cold crazy. She should not be allowed to do that with the stocks.”

Pelosi, who once argued that lawmakers “should be able to participate in capitalism,” later shifted her position under mounting bipartisan pressure. Her reversal came as members from both parties began pushing for a comprehensive trading ban to restore public trust.

Bipartisan Efforts Aim to Restore Trust

Senator Jon Ossoff (D-GA) and Senator Josh Hawley (R-MO) are among the most vocal advocates for reform. Ossoff has sought a Republican co-sponsor for a bill that would prohibit members of Congress — and their immediate families — from owning or trading individual stocks while in office.

Sen. Hawley introduced the Banning Insider Trading in Congress Act, which would require lawmakers and their spouses to divest or place their assets in blind trusts. Under the proposal, any member found to have violated the law would be forced to return profits to the American people.

“Year after year, politicians somehow manage to outperform the market,” Hawley said in a statement. “Wall Street and Big Tech work hand-in-hand with elected officials to enrich each other at the expense of the country. It’s time to stop turning a blind eye to Washington profiteering.”

Public opinion polls consistently show broad bipartisan support for such restrictions, with over 75% of Americans favoring a total ban on stock trading by sitting lawmakers, according to Gallup.

The Pelosi Legacy and Questions Ahead

Pelosi, who announced she will retire from Congress in 2027, leaves behind a complex legacy — one that intertwines decades of political leadership with persistent questions about personal wealth and ethics in public office.

Her defenders point to her long record of public service and note that her husband, a private investor, has been active in the stock market for decades. Her critics argue that even if no laws were broken, the appearance of potential insider advantage undermines public confidence in government integrity.

“Even if every trade was legal,” one ethics expert noted, “the public perception is what matters. Americans need to believe their representatives are acting in the nation’s interest — not their own.”

As Congress continues to debate reforms, the issue shows no sign of fading. Pelosi’s career may be nearing its end, but the controversy surrounding financial transparency in Washington is only just beginning.

What’s Next for Reform Efforts

The proposed trading bans have yet to reach a full floor vote, but both Democratic and Republican leaders have acknowledged the mounting pressure from voters. Some lawmakers have even suggested expanding the legislation to cover senior staffers and cabinet officials, not just elected members.

Supporters of the bill argue that prohibiting individual stock trading would reduce conflicts of interest and rebuild trust in public institutions. Opponents counter that it could deter qualified professionals from seeking office or limit their financial independence.

Regardless of which side prevails, Pelosi’s financial journey — and the broader debate it represents — is likely to shape congressional ethics policy for years to come.

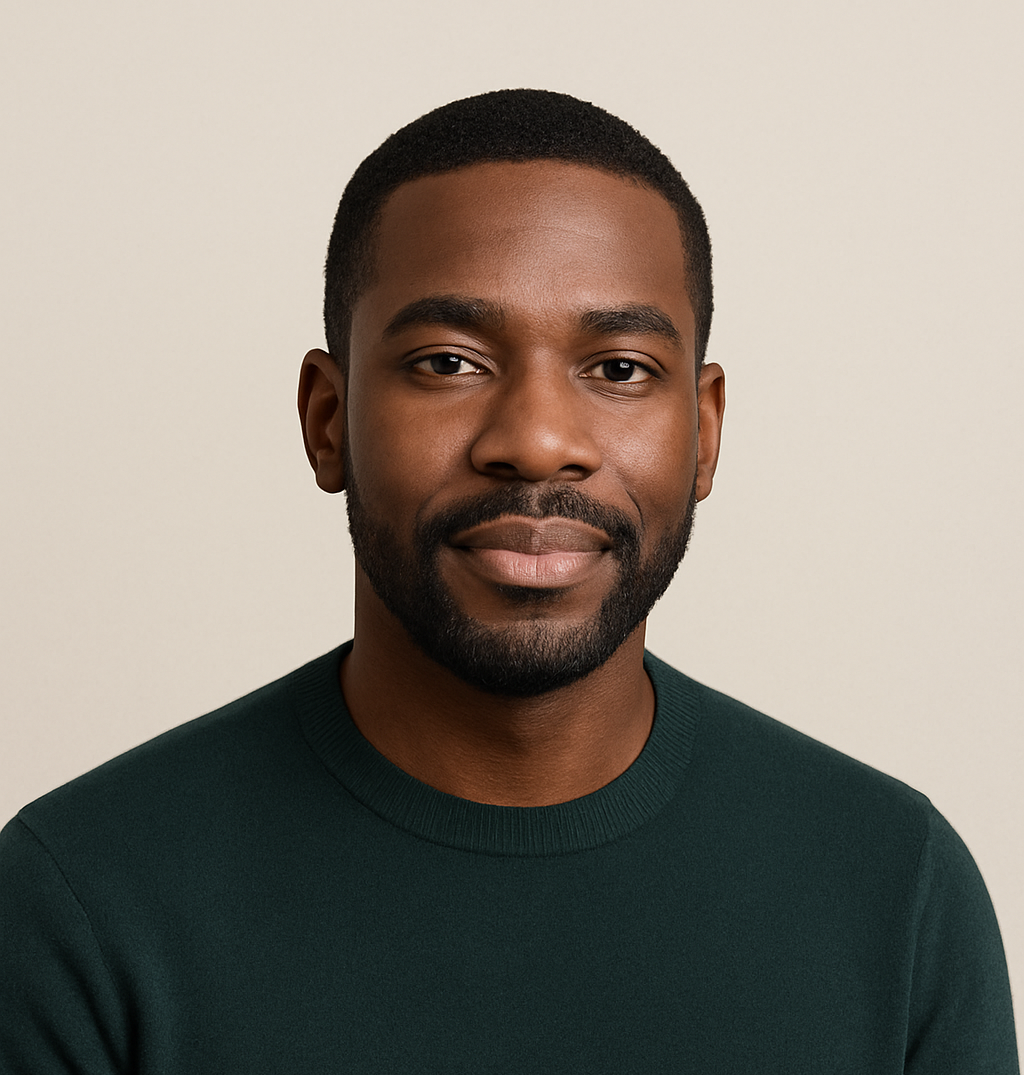

James Jenkins is a celebrated Pulitzer Prize-winning author whose work has reshaped the way readers think about social justice and human rights in America. Raised in Atlanta, Georgia, James grew up in a community that instilled in him both resilience and a strong sense of responsibility toward others. After studying political science and creative writing at Howard University, he worked as a journalist covering civil rights issues before dedicating himself fully to fiction. His novels are known for their sharp, empathetic portraits of marginalized communities and for weaving personal stories with broader political realities. Jenkins’s breakout novel, Shadows of Freedom, won national acclaim for its unflinching look at systemic inequality, while his more recent works explore themes of identity, resilience, and the fight for dignity in the face of oppression. Beyond his novels, James is an active public speaker, lecturing at universities and participating in nonprofit initiatives that support literacy and community empowerment. He believes that storytelling is a way to preserve history and inspire change. When not writing, James enjoys jazz music, mentoring young writers, and traveling with his family to explore cultures and stories around the world.