In January 2023, the Internal Revenue Service filed a federal tax lien against EStreetCo, a company once co-owned by Tim Mynett, the husband of Rep. Ilhan Omar (D-MN). The lien, filed in Sonoma County, California, alleged that the company failed to pay nearly $206,000 in income, Social Security, and Medicare taxes owed for the 2021 tax year. This filing came months after the company’s formal dissolution in June 2022.

The case highlights the intersection of business, politics, and regulatory oversight. While tax disputes involving private firms are not uncommon, the involvement of a company once associated with a high-profile political figure’s spouse has drawn considerable attention. The development raises questions about compliance procedures, public scrutiny, and the mechanics of how federal tax liens are recorded, managed, and ultimately resolved.

Background of the Company

EStreetCo was launched in October 2020 by Tim Mynett and his business partner, Will Hailer, a former adviser to the Democratic National Committee. According to archived versions of its website, the firm described itself as a creative agency offering services in advertising, design, and public relations. At its peak, it reportedly employed at least 17 staff members.

In Rep. Omar’s 2021 congressional financial disclosure forms, she listed her husband’s stake in EStreetCo as being valued at no more than $1,000. This coincided with the time period during which the IRS alleges the company failed to pay its required employment taxes. The company officially dissolved in mid-2022, roughly seven months before the IRS filed its lien.

It is important to note that the lien pertains specifically to EStreetCo and not to Mynett’s earlier venture, the E Street Group. The latter is better known for its work in political consulting and was a recipient of millions of dollars in campaign payments, including funds from Omar’s own campaign during the 2020 election cycle. No known tax liens have been filed against that business.

Details of the Lien

The lien filed by the IRS in Sonoma County cited unpaid obligations totaling nearly $206,000 for the 2021 tax year. Such liens are a routine legal mechanism used by the IRS to protect the government’s interest in recovering unpaid federal taxes. When filed, they become part of the public record and are often used by the government as leverage to ensure eventual repayment or settlement.

While the lien was officially filed in January 2023, questions soon arose about whether the underlying tax liability remained outstanding. According to reports, EStreetCo representatives later stated that the company had addressed the tax matter fully.

Company’s Response

A spokesman for EStreetCo told the Washington Free Beacon that the alleged tax debt had been resolved and, in fact, the company was due a refund. He provided IRS account transcripts dated September 3, 2025, which showed that not only had the balance been cleared, but the agency now owed the company a credit of just over $3,000.

Despite this claim, the lien remains listed as active in Sonoma County’s public records. That discrepancy underscores the often-lengthy administrative process of updating or removing liens, even after the IRS has received payment or determined that no outstanding liability exists. The IRS itself has not publicly commented on the case, consistent with its general policy of not discussing individual taxpayer matters.

Political and Public Scrutiny

Although the lien and its resolution are primarily financial and administrative in nature, the matter has attracted attention due to its connection to Rep. Ilhan Omar. Public officials and their families are often subject to heightened scrutiny regarding financial dealings, given the potential for public perception issues. However, it is important to emphasize that the lien was tied to Mynett’s business venture and not to Omar’s congressional office or campaign.

The fact that EStreetCo was dissolved before the lien was filed further complicates public interpretation. Dissolution of a company does not shield it from outstanding obligations, and liens may still be filed against the business entity for debts incurred while it was active.

The Broader Context of Tax Liens

Tax liens are not unusual in the business world. The IRS files thousands of liens annually against companies and individuals who fall behind on federal tax obligations. Such liens serve as a notice to creditors and the public that the government has a legal claim against the taxpayer’s property, including real estate, financial accounts, and other assets. While liens may sound alarming, they often represent an intermediate step in a process that can ultimately end in payment, settlement, or resolution in the taxpayer’s favor.

In this case, the presence of the lien in public records contrasts with the company’s assertion that the liability has been settled. That contrast illustrates how tax disputes may persist in the public eye even after they are functionally resolved. The lag between administrative updates and legal filings often contributes to confusion.

Implications Moving Forward

For Mynett and Omar, the implications of the lien may be less about legal exposure and more about public optics. Financial controversies, even when addressed, can linger in political narratives. For Omar’s critics, the existence of the lien may serve as a talking point, while her supporters are likely to emphasize the company’s claim that the debt has been fully resolved.

For EStreetCo, which no longer operates, the matter largely centers on ensuring that public records are updated to reflect the company’s current standing with the IRS. Until that occurs, the lien remains part of the company’s historical record, accessible through county filings.

Lessons on Transparency and Public Records

This episode highlights several broader lessons about transparency and public records:

- Accuracy vs. Perception: Even when debts are paid, public perception can lag behind due to the slower pace of record updates.

- Importance of Documentation: The provision of IRS transcripts by EStreetCo offers a rare window into how such disputes may be resolved administratively, though the ultimate resolution depends on official updates to county filings.

- Heightened Scrutiny for Public Figures: When political families are involved, even relatively common financial disputes can take on larger significance.

Conclusion

The IRS tax lien filed against EStreetCo represents a straightforward legal mechanism for collecting alleged unpaid taxes, but the case has attracted outsized attention because of its connection to Rep. Ilhan Omar’s husband, Tim Mynett. While records confirm that the lien was filed for nearly $206,000 in unpaid 2021 taxes, the company has produced evidence suggesting the debt was resolved and that the IRS now owes a small credit. The lien remains listed in public county records, highlighting the complexities of bureaucratic processes and the gap that can exist between financial resolution and public documentation.

As of now, the most verifiable facts are these: a lien was filed, the company claims the debt has been resolved with supporting IRS transcripts, and the official release of the lien has not yet been recorded at the county level. The matter underscores both the procedural nature of tax collection and the way financial issues tied to public figures can attract enduring scrutiny, even when the amounts in question have already been addressed.

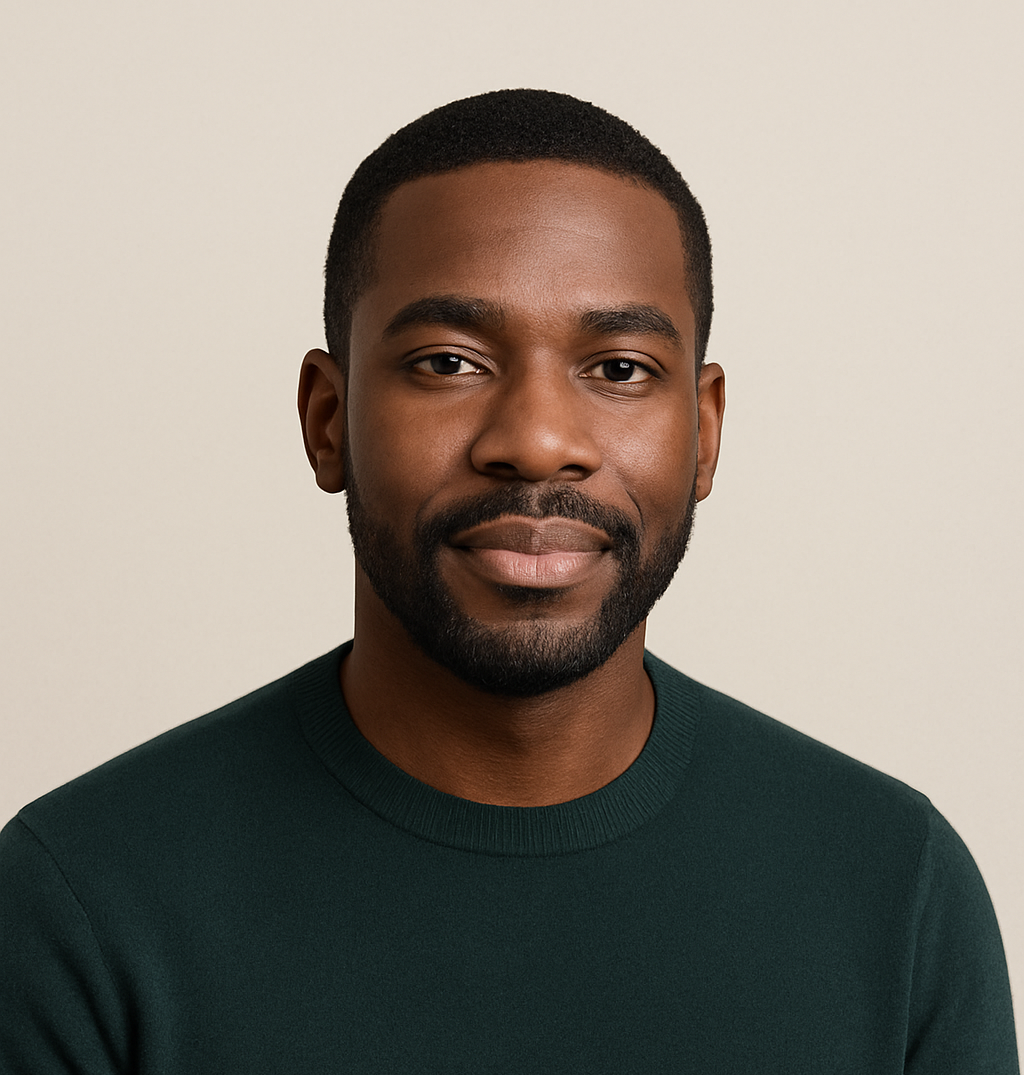

James Jenkins is a celebrated Pulitzer Prize-winning author whose work has reshaped the way readers think about social justice and human rights in America. Raised in Atlanta, Georgia, James grew up in a community that instilled in him both resilience and a strong sense of responsibility toward others. After studying political science and creative writing at Howard University, he worked as a journalist covering civil rights issues before dedicating himself fully to fiction. His novels are known for their sharp, empathetic portraits of marginalized communities and for weaving personal stories with broader political realities. Jenkins’s breakout novel, Shadows of Freedom, won national acclaim for its unflinching look at systemic inequality, while his more recent works explore themes of identity, resilience, and the fight for dignity in the face of oppression. Beyond his novels, James is an active public speaker, lecturing at universities and participating in nonprofit initiatives that support literacy and community empowerment. He believes that storytelling is a way to preserve history and inspire change. When not writing, James enjoys jazz music, mentoring young writers, and traveling with his family to explore cultures and stories around the world.