The first Social Security payments reflecting 2026 benefit increases are being sent out this week, marking a key moment for millions of Americans who rely on the program as inflation continues to reshape household finances.

According to the Social Security Administration, recipients will see a 2.8 percent cost-of-living adjustment, or COLA, applied to their checks. For some beneficiaries, the updated payments will arrive as early as Dec. 31, 2025, due to the New Year’s Day federal holiday.

Roughly 71 million Americans receive Social Security benefits, while another 7.5 million receive Supplemental Security Income (SSI), making the annual adjustment one of the most closely watched financial changes of the year.

A 2.8 Percent Boost Takes Effect

The 2.8 percent COLA increase for 2026 follows several years of elevated inflation and larger benefit adjustments. While the increase is smaller than recent spikes, it still translates into a meaningful bump for many retirees and disabled beneficiaries.

On average, the increase adds about $56 per month to Social Security checks, though the exact amount varies based on an individual’s earnings history and benefit level.

The adjustment applies automatically, and beneficiaries do not need to take any action to receive the higher payments.

Who Gets Paid First in January

Payment timing for January depends on the type of benefits received and when beneficiaries first began collecting Social Security.

Recipients who also receive SSI will get their January 2026 SSI payment early, on Dec. 31, 2025, because Jan. 1 is a federal holiday. Those who started receiving retirement, spousal, or survivor benefits before May 1997 will receive their first 2026 Social Security payment on Jan. 2.

People who receive both SSI and Social Security are paid SSI on the first of each month and Social Security on the third of each month.

For everyone else, Social Security payments are issued on Wednesdays, based on birth dates:

-

Birthdays between the 1st and 10th: second Wednesday (Jan. 14)

-

Birthdays between the 11th and 20th: third Wednesday (Jan. 21)

-

Birthdays between the 21st and 31st: fourth Wednesday (Jan. 28)

Notices Already Sent to Beneficiaries

The SSA said most recipients received notices in December explaining their new monthly benefit amounts. Beneficiaries can also view personalized COLA adjustments by logging into their online Social Security accounts.

The agency encourages recipients to review those notices carefully, particularly if they have Medicare premiums deducted directly from their Social Security checks.

Medicare Premiums May Offset Gains

While the COLA increases gross benefit amounts, many seniors will not see the full increase reflected in their net payments.

Medicare Part B premiums are rising in 2026, which will offset part of the COLA for beneficiaries whose premiums are deducted automatically. Part B covers outpatient services such as doctor visits, preventive care, diagnostic tests, mental health treatment, and medical equipment.

Medicare Part A, which covers inpatient hospital care, remains premium-free for most recipients.

Higher-income beneficiaries pay income-related monthly adjustment amounts, meaning their Part B premiums may increase even more sharply.

How the COLA Is Calculated

The COLA is based on inflation data from the third quarter of the prior year — July, August, and September — using the Consumer Price Index for Urban Wage Earners and Clerical Workers, known as CPI-W.

Inflation cooled during that period compared with earlier years, resulting in a smaller adjustment for 2026 than the historic 8.7 percent increase in 2023 and the 3.2 percent increase in 2024. Beneficiaries received a 2.5 percent boost in 2025.

SSA Commissioner Frank Bisignano said the annual adjustment helps benefits reflect economic conditions.

“The cost-of-living adjustment is one way we are working to make sure benefits reflect today’s economic realities and continue to provide a foundation of security,” Bisignano said in a statement.

Payroll Tax Cap Increases in 2026

The COLA is financed through payroll taxes collected from workers and employers. In 2026, the maximum amount of earnings subject to Social Security payroll taxes will rise to $184,500, up from $176,100 in 2025.

Only income up to that cap is taxed for Social Security purposes, meaning higher earners will pay payroll taxes on a larger portion of their income next year.

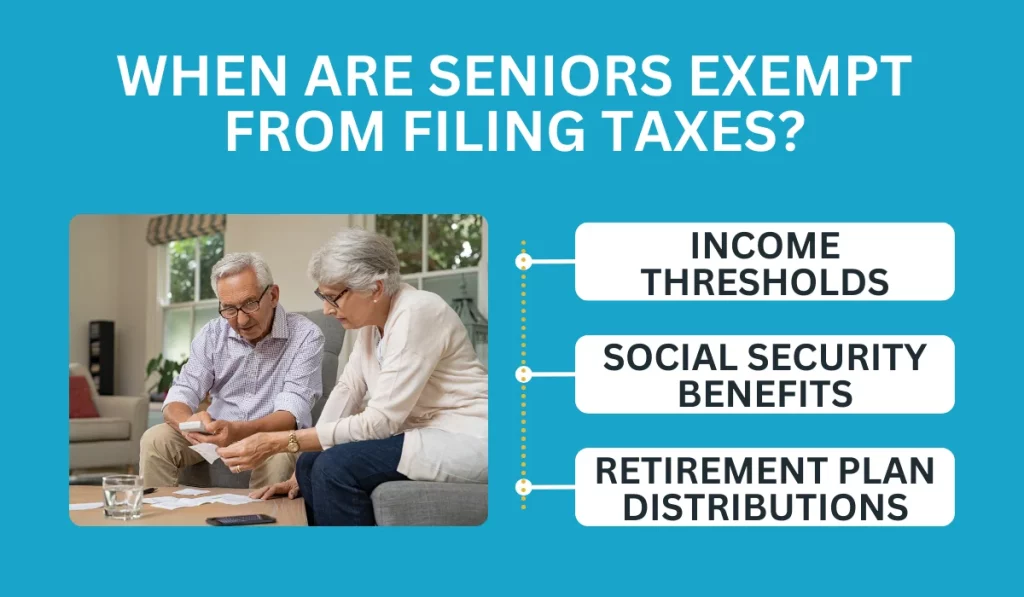

New Tax Deduction for Seniors

Beyond higher monthly benefits, many seniors will also see tax relief starting this year.

Under a tax and spending bill signed over the summer, the Trump administration introduced a temporary tax deduction for seniors aged 65 and older. The deduction applies to all income, not just Social Security benefits, and is effective from 2025 through 2028.

Eligible seniors can claim an additional $6,000 deduction on top of the existing standard deduction. The measure is designed to reduce tax burdens for middle-income retirees.

However, not everyone qualifies. Seniors who already pay no taxes on Social Security due to low income, those who claim benefits before age 65, and those above certain income thresholds are excluded.

IRS Confirms Timeline

The Internal Revenue Service confirmed the senior deduction will remain in effect through the end of President Donald Trump’s second term, expiring in 2028 unless extended by Congress.

Tax professionals are urging seniors to review their withholding and consult advisers to understand how the deduction may affect their overall tax liability.

Critics Say COLA Falls Short

Despite the increase, advocacy groups argue the 2.8 percent COLA does not reflect the true cost pressures facing older Americans.

The Senior Citizens League says the CPI-W underestimates expenses such as healthcare, prescription drugs, housing, and long-term care — costs that disproportionately affect retirees.

AARP Research found that 77 percent of Americans aged 50 and older believe Social Security COLAs are insufficient to keep up with rising living costs.

Some advocates continue to push for a different inflation measure tailored to seniors, though no such change has been adopted.

What Beneficiaries Should Do Now

Experts recommend that beneficiaries:

-

Review their COLA notice and payment schedule

-

Check net benefit amounts after Medicare deductions

-

Monitor tax implications for 2026

-

Be cautious of scams targeting seniors during payment changes

The SSA warns that scammers often impersonate agency officials around COLA announcements and payment shifts.

A Modest Increase in an Uncertain Economy

While the 2026 COLA is smaller than in recent years, it still provides incremental relief as seniors navigate higher healthcare and housing costs.

For millions of Americans, Social Security remains the backbone of retirement income. As inflation moderates but expenses remain elevated, beneficiaries are watching closely to see whether future adjustments will keep pace with their real-world costs.

For now, the first 2026 payments are on the way — bringing a new year of benefits, adjustments, and ongoing debate over whether the system is doing enough to protect retirees’ financial security.

Emily Johnson is a critically acclaimed essayist and novelist known for her thought-provoking works centered on feminism, women’s rights, and modern relationships. Born and raised in Portland, Oregon, Emily grew up with a deep love of books, often spending her afternoons at her local library. She went on to study literature and gender studies at UCLA, where she became deeply involved in activism and began publishing essays in campus journals. Her debut essay collection, Voices Unbound, struck a chord with readers nationwide for its fearless exploration of gender dynamics, identity, and the challenges faced by women in contemporary society. Emily later transitioned into fiction, writing novels that balance compelling storytelling with social commentary. Her protagonists are often strong, multidimensional women navigating love, ambition, and the struggles of everyday life, making her a favorite among readers who crave authentic, relatable narratives. Critics praise her ability to merge personal intimacy with universal themes. Off the page, Emily is an advocate for women in publishing, leading workshops that encourage young female writers to embrace their voices. She lives in Seattle with her partner and two rescue cats, where she continues to write, teach, and inspire a new generation of storytellers.