The U.S. Justice Department has launched a criminal investigation into Lisa Cook, the former Federal Reserve Governor dismissed last week by President Donald Trump amid allegations of mortgage fraud. The move adds another layer of political and legal drama to an already contentious period for the nation’s central bank, where Cook’s removal has intensified debates over independence, accountability, and political influence.

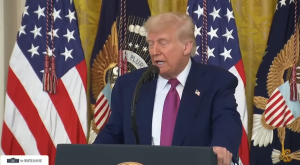

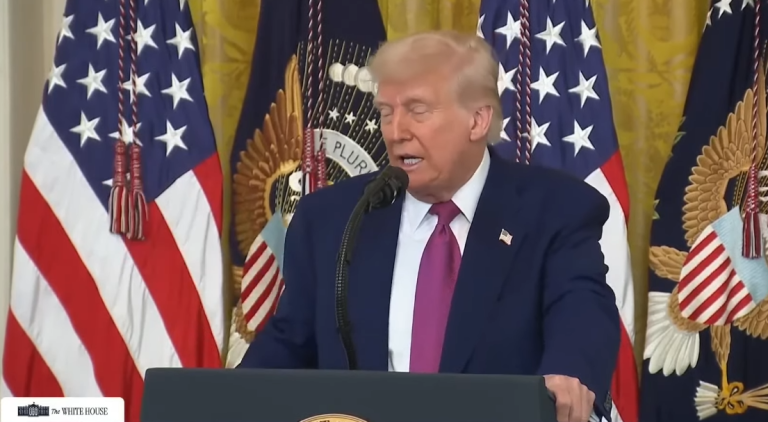

A High-Profile Dismissal

Lisa Cook, who joined the Federal Reserve Board of Governors in 2022 under an appointment by then-President Joe Biden, became the first Black woman to serve on the Fed’s powerful seven-member board. Her appointment was hailed at the time as a historic moment, reflecting both her academic expertise in economics and her trailblazing background in a field long dominated by men.

Her tenure, however, was cut short when President Trump fired her in late August 2025, citing allegations that she had improperly claimed two different primary residences in order to secure favorable mortgage terms. The referral to the Department of Justice came from William Pulte, Director of the Federal Housing Finance Agency (FHFA) and a close ally of Trump.

Trump, who has clashed repeatedly with the Federal Reserve over interest rates and monetary policy, immediately pointed to Pulte’s referral as justification for Cook’s removal. Her dismissal cleared the way for Trump to expand his influence over the board, which plays a decisive role in setting borrowing costs for households and businesses across the country.

Mortgage Fraud Allegations

At the heart of the DOJ probe are claims that Cook may have submitted fraudulent mortgage applications for two properties—one in Ann Arbor, Michigan, and another in Atlanta, Georgia.

According to Pulte’s referral, Cook allegedly declared both properties as “primary residences,” a status that often qualifies borrowers for more favorable loan terms, including lower interest rates and reduced down payment requirements. If proven, such a misrepresentation could constitute mortgage fraud, a federal offense.

Prosecutors are reportedly examining loan documents, residency records, and financial statements to determine whether Cook knowingly provided false information. The Wall Street Journal reported that grand juries have already been convened in connection with the case, though no charges have yet been filed.

Legal Fight to Return to the Fed

Even as the investigation unfolds, Cook has taken the unusual step of suing for reinstatement to the Federal Reserve Board. Her legal team argues that her removal was politically motivated and lacked the due process protections typically afforded to high-level federal appointees.

The lawsuit raises critical questions about the limits of presidential power over the Federal Reserve. While board members are confirmed by the Senate for 14-year terms, the statute governing the Fed provides limited guidance on the circumstances under which a governor may be dismissed. Trump’s action could set a precedent for future presidents seeking to reshape the board through removal rather than natural attrition.

Cook’s allies in Washington, particularly among Democrats, have framed her dismissal as part of a broader effort by Trump to undermine the Fed’s independence. They note that Cook had frequently voted with other Biden-era appointees to support a more cautious approach to lowering interest rates, a stance that sometimes clashed with Trump’s calls for rapid monetary easing.

Political Undercurrents

The investigation into Lisa Cook is not occurring in isolation. It marks the third referral for criminal investigation made by FHFA Director William Pulte in recent months.

-

Earlier this year, Pulte sought an investigation into New York Attorney General Letitia James, who oversaw Trump’s civil fraud trial.

-

He also filed a referral against Sen. Adam Schiff (D-Calif.), a vocal critic of Trump and a leading member of the House committee investigating the January 6th Capitol attack.

Critics argue that Pulte’s pattern of referrals represents a political strategy designed to target Democratic officials and undermine their credibility. Supporters counter that Pulte is fulfilling his statutory duties by reporting potential financial misconduct, regardless of political affiliation.

The Justice Department has not commented publicly on whether the referrals involving James or Schiff led to formal investigations. In Cook’s case, however, prosecutors appear to have taken the allegations seriously enough to begin a full-scale probe.

Implications for the Federal Reserve

The investigation and Cook’s dismissal come at a pivotal moment for the Federal Reserve, which has been navigating delicate decisions on interest rates, inflation, and employment. The Fed’s independence is a cornerstone of its credibility, designed to shield monetary policy from short-term political pressures.

Cook’s removal could tilt the balance of power within the board in Trump’s favor, giving him greater influence over decisions that affect the entire U.S. economy. Critics fear this may lead to policies designed to boost short-term economic performance at the expense of long-term stability.

At the same time, the controversy risks undermining public trust in the institution. If Fed governors can be removed based on untested allegations or partisan disputes, observers worry that future policymakers will hesitate to make decisions contrary to the White House’s political agenda.

Cook’s Background and Legacy

Before joining the Fed, Lisa Cook had a distinguished career as a professor of economics and international relations at Michigan State University. Her research spanned topics from financial systems in emerging markets to the effects of racial violence on economic outcomes in the United States.

She also served in advisory roles under previous administrations, including as a senior adviser at the U.S. Treasury Department. Her appointment to the Federal Reserve was celebrated as a long-overdue step toward diversifying the leadership of the central bank, both in terms of race and academic perspective.

Her allies argue that the allegations now facing her do not diminish her contributions or qualifications, and they warn that removing her under a cloud of suspicion threatens to deter other accomplished professionals from public service.

What Comes Next

For now, the future of Lisa Cook’s career—and the balance of power within the Federal Reserve—hangs in the balance. The Justice Department’s investigation could take months to conclude, and the grand juries will ultimately determine whether sufficient evidence exists to bring charges.

Meanwhile, Cook’s lawsuit to regain her seat on the Fed board will proceed through the courts. Legal experts say the case could test the limits of presidential authority in ways not seen since the Fed’s creation in 1913.

Whether she is vindicated or convicted, the fallout from the case is likely to reverberate well beyond her personal fate. It will shape debates about the independence of the Federal Reserve, the politicization of financial oversight, and the standards of accountability for public officials at the highest levels of government.

Conclusion

The Justice Department’s probe into Lisa Cook is more than a personal legal battle—it is a flashpoint in a broader struggle over the future of America’s central bank and the role of politics in financial governance.

As investigators comb through mortgage records in Michigan and Georgia, and as lawyers prepare for courtroom battles in Washington, the stakes remain unusually high. Cook’s dismissal and the investigation that followed could define not only her legacy but also the trajectory of the Federal Reserve at a moment when public trust in institutions is already strained.

James Jenkins is a celebrated Pulitzer Prize-winning author whose work has reshaped the way readers think about social justice and human rights in America. Raised in Atlanta, Georgia, James grew up in a community that instilled in him both resilience and a strong sense of responsibility toward others. After studying political science and creative writing at Howard University, he worked as a journalist covering civil rights issues before dedicating himself fully to fiction. His novels are known for their sharp, empathetic portraits of marginalized communities and for weaving personal stories with broader political realities. Jenkins’s breakout novel, Shadows of Freedom, won national acclaim for its unflinching look at systemic inequality, while his more recent works explore themes of identity, resilience, and the fight for dignity in the face of oppression. Beyond his novels, James is an active public speaker, lecturing at universities and participating in nonprofit initiatives that support literacy and community empowerment. He believes that storytelling is a way to preserve history and inspire change. When not writing, James enjoys jazz music, mentoring young writers, and traveling with his family to explore cultures and stories around the world.