Major Court Ruling in New York Could Change Everything for Trump

One of the most closely watched legal battles in recent memory just took a dramatic turn, and the ripple effects could be massive—not just for the former president, but for the entire political and financial landscape.

For months, this case has dominated headlines. It involved accusations, billion-dollar properties, and a judgment so large that it raised questions about whether one of the world’s most recognizable business empires could survive the hit. Now, a new decision has shifted the conversation entirely.

The Case Everyone Was Watching

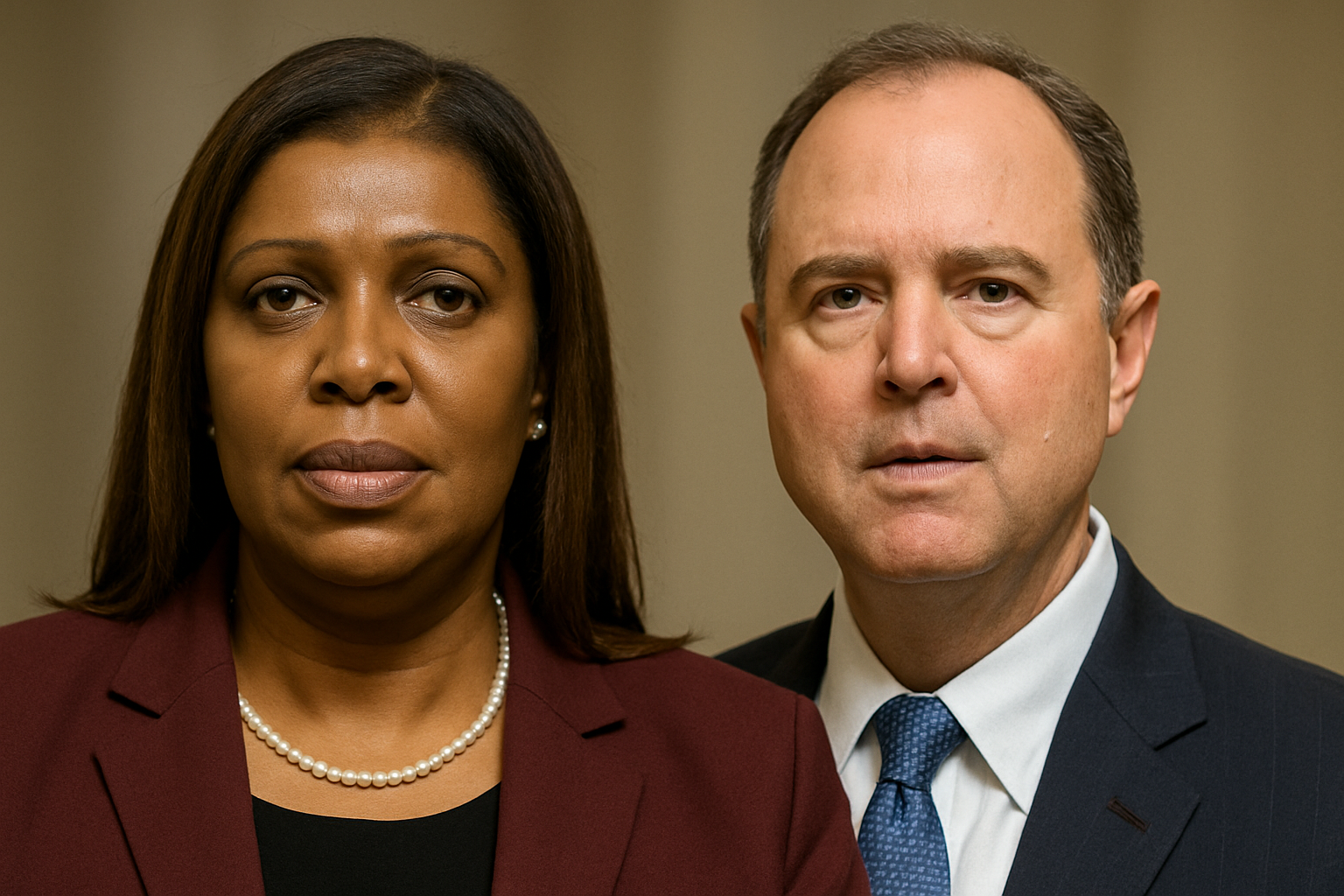

At the center of this legal storm is a complex financial dispute that stems from years of valuations, high-stakes loans, and allegations of misrepresentation. New York Attorney General Letitia James launched the lawsuit in an effort to hold the former president accountable for what her office called a pattern of deception spanning a decade.

According to prosecutors, the numbers didn’t add up. They claimed that some of the most iconic properties in Trump’s portfolio—including the lavish Trump Tower penthouse and the famous Mar-a-Lago estate—were inflated in value to secure more favorable financial terms.

The scale of the accusations shocked even seasoned observers. At one point, it was suggested that an apartment in Trump Tower had been listed at nearly three times its actual size, leading to a valuation of over $300 million. The Mar-a-Lago estate, meanwhile, became a flashpoint in the debate over what constitutes fair market value versus strategic financial positioning.

For the Attorney General’s team, these discrepancies weren’t just clerical errors—they were the foundation of a broader scheme that could undermine trust in financial markets. For Trump’s legal team, however, the accusations were nothing more than political theater, designed to weaken him as he eyed another presidential run.

The Stakes Couldn’t Have Been Higher

Earlier this year, the trial court handed down a judgment so staggering that it sent shockwaves across the legal and political worlds: a financial penalty that, with interest, soared well past the half-billion-dollar mark.

The decision was hailed by some as a triumph of accountability, while others saw it as government overreach of the highest order. Trump himself called it a “witch hunt,” insisting that no banks or insurers had ever lost money on deals connected to his organization.

At the heart of the controversy was a law that doesn’t require proof of actual financial harm to pursue civil fraud—a point of contention during appeals arguments, where judges openly questioned whether the case had expanded beyond its intended scope.

What the Judges Said

During oral arguments, the five-judge appellate panel raised concerns that the legal theory underpinning the case might be too broad. One judge asked bluntly whether the statute had “morphed into something it was not meant to do.”

Trump’s attorneys seized on that line of questioning, reiterating their position that lenders like Deutsche Bank not only conducted their own evaluations but were repaid in full, with interest. “There are no victims here,” they argued.

Meanwhile, the Attorney General’s office countered that falsifying valuations could destabilize the entire financial system if left unchecked. Even if no immediate harm occurred, they insisted, the risk was real and ongoing.

The Bombshell Ruling

After months of speculation, the appeals court finally issued its decision—and it’s a game-changer. The massive financial judgment that once loomed over Trump’s empire is gone.

That’s right: the appellate court overturned the $464 million civil judgment, throwing out one of the largest penalties ever levied against a business figure in New York.

But before anyone declares this a total victory, there’s a catch: the ruling left in place certain business restrictions, and the Attorney General has already vowed to take the fight to New York’s highest court. In other words, the legal drama is far from over.

Trump, however, wasted no time framing the decision as a major win, calling it proof that the original ruling was politically motivated. His critics, meanwhile, argue that the door remains open for future accountability.

What happens next will depend on the Court of Appeals—but for now, the immediate threat of a $464 million penalty has been lifted, marking a turning point in one of the most high-profile legal showdowns in recent memory.

https://twitter.com/ThePatriotOasis/status/1958541669441155229

James Jenkins is a celebrated Pulitzer Prize-winning author whose work has reshaped the way readers think about social justice and human rights in America. Raised in Atlanta, Georgia, James grew up in a community that instilled in him both resilience and a strong sense of responsibility toward others. After studying political science and creative writing at Howard University, he worked as a journalist covering civil rights issues before dedicating himself fully to fiction. His novels are known for their sharp, empathetic portraits of marginalized communities and for weaving personal stories with broader political realities. Jenkins’s breakout novel, Shadows of Freedom, won national acclaim for its unflinching look at systemic inequality, while his more recent works explore themes of identity, resilience, and the fight for dignity in the face of oppression. Beyond his novels, James is an active public speaker, lecturing at universities and participating in nonprofit initiatives that support literacy and community empowerment. He believes that storytelling is a way to preserve history and inspire change. When not writing, James enjoys jazz music, mentoring young writers, and traveling with his family to explore cultures and stories around the world.