In a bold new move, President Donald Trump has unveiled a sweeping tax reform proposal aimed directly at middle-class Americans, blue-collar workers, and retirees. The plan, rolled out by White House Press Secretary Karoline Leavitt, calls for eliminating federal taxes on tips, overtime pay, and Social Security benefits — a trio of changes intended to significantly increase take-home pay for millions.

Leavitt emphasized that this is part of a broader agenda to “put working Americans first” and close what the administration calls “rigged loopholes” favoring the ultra-wealthy.

WHAT’S IN THE PLAN?

The proposal includes:

✅ No Federal Taxes on Tips — Service industry workers like restaurant staff, barbers, and hospitality employees would keep more of what they earn.

✅ No Taxes on Social Security Benefits — Retirees would no longer see a portion of their Social Security income taxed by the federal government.

✅ No Taxes on Overtime Pay — Workers pulling extra hours would be rewarded, not penalized, for their effort.

The plan also pushes for a permanent extension of the 2017 Tax Cuts and Jobs Act, which lowered individual tax rates and cut the corporate tax rate from 35% to 21%.

Now, Trump wants to go even further — slashing the corporate tax rate again, this time to 15%, arguing it will drive investment, create jobs, and make America the most competitive economy in the world.

THE LOOPHOLE CRACKDOWN

Alongside cuts, the plan includes closing several loopholes, including the carried interest loophole — long criticized for allowing hedge fund managers to pay lower tax rates than middle-class workers.

WHO SUPPORTS IT?

Conservative lawmakers are lining up behind the effort. Sen. Josh Hawley called it “a win for the American worker.”

Even libertarian-leaning Sen. Rand Paul gave it cautious backing: “I like what I’m seeing, but we need to pair this with smart spending reform.”

THE PUSHBACK

Democrats are already calling foul. Rep. Hakeem Jeffries slammed the plan, calling it “a Trojan horse for corporate giveaways.”

Critics warn the cuts could drive up the national debt unless paired with budget reductions, and argue that corporations — not workers — will pocket most of the gains from further business tax cuts.

Still, the Trump team insists that giving more breathing room to everyday Americans is the top priority — and they’re betting this proposal will resonate with voters heading into the next election cycle.

WHAT COMES NEXT?

The tax plan is expected to face fierce debate in Congress, with Republicans aiming to fast-track parts of it before the TCJA provisions expire in 2025. One thing’s certain: the battle lines over taxes, spending, and economic fairness are about to get redrawn.

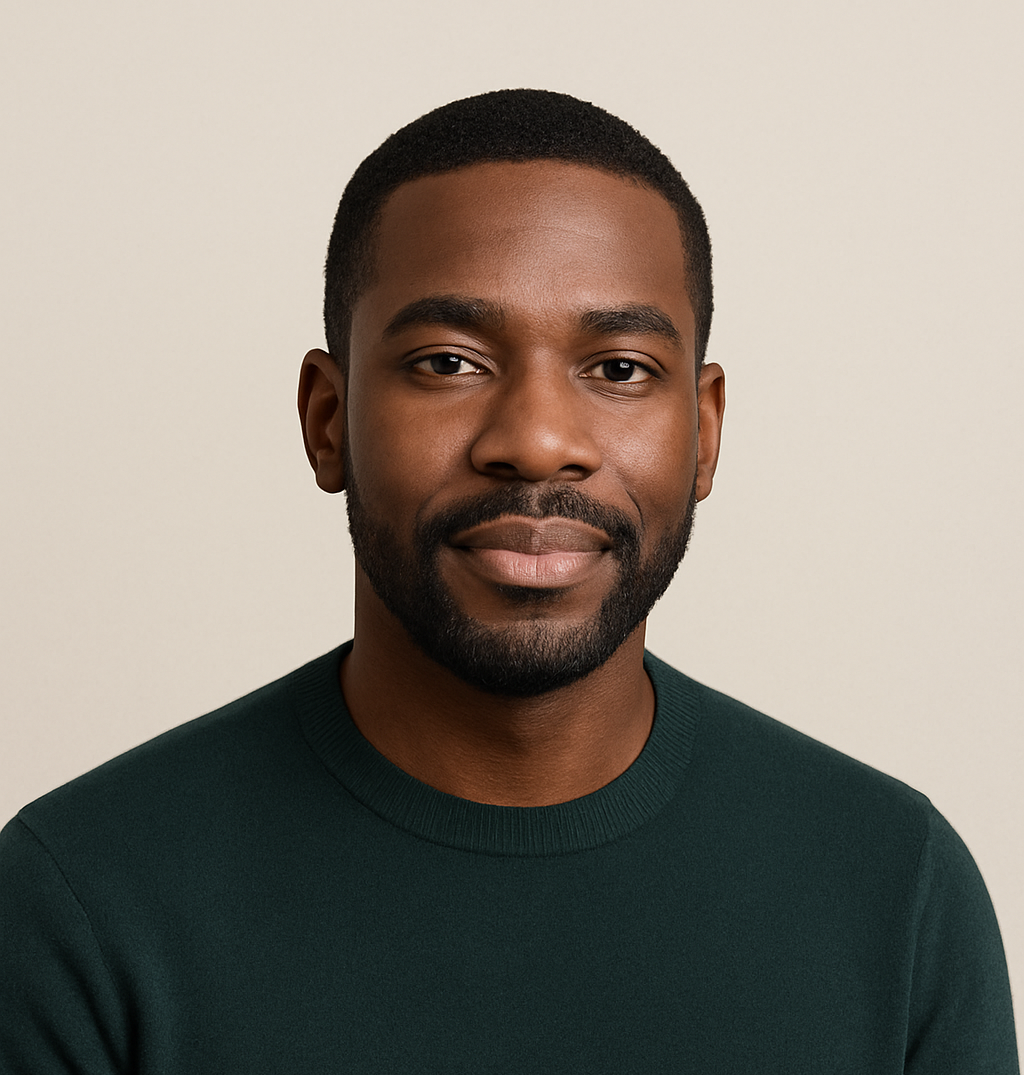

James Jenkins is a celebrated Pulitzer Prize-winning author whose work has reshaped the way readers think about social justice and human rights in America. Raised in Atlanta, Georgia, James grew up in a community that instilled in him both resilience and a strong sense of responsibility toward others. After studying political science and creative writing at Howard University, he worked as a journalist covering civil rights issues before dedicating himself fully to fiction. His novels are known for their sharp, empathetic portraits of marginalized communities and for weaving personal stories with broader political realities. Jenkins’s breakout novel, Shadows of Freedom, won national acclaim for its unflinching look at systemic inequality, while his more recent works explore themes of identity, resilience, and the fight for dignity in the face of oppression. Beyond his novels, James is an active public speaker, lecturing at universities and participating in nonprofit initiatives that support literacy and community empowerment. He believes that storytelling is a way to preserve history and inspire change. When not writing, James enjoys jazz music, mentoring young writers, and traveling with his family to explore cultures and stories around the world.