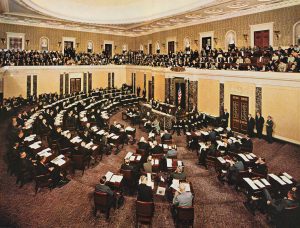

The White House is once again fueling debate in Washington over executive authority, fiscal policy, and the role of Congress, after the president suggested that large rebate checks funded by tariff revenue could be issued directly to Americans without new legislation. The remarks have reignited questions about the limits of presidential power, the sustainability of tariff-driven revenue, and whether such a program could survive legal and political scrutiny.

Speaking to reporters ahead of an overseas trip, the president indicated that congressional approval might not be necessary to move forward with rebate payments tied to import duties. While he stopped short of outlining a formal mechanism, his comments suggested that the executive branch believes it has sufficient authority to distribute funds generated through tariffs under existing law.

The proposal centers on issuing rebate checks worth as much as $2,000 per household, financed by revenue collected from import tariffs imposed over the past year. Administration officials have increasingly described the idea as a way to return money directly to Americans while simultaneously addressing the nation’s ballooning debt. Supporters argue the plan would allow working families to benefit from trade enforcement policies, while critics warn it could deepen budget deficits and invite legal challenges.

According to the president, the reason such a proposal is even under consideration is the sheer scale of tariff revenue flowing into federal coffers. Import duties have surged amid an aggressive trade posture, producing what the administration describes as “hundreds of billions of dollars” in new revenue. That influx, the president said, opens the door to what he framed as a “substantial dividend” for the American public.

Although details remain limited, the White House has consistently signaled that any rebate program would include income limits. The president reiterated that the checks would not go to high earners, instead targeting middle- and lower-income households. In past remarks, he has described the concept as benefits for “everybody but the rich,” framing it as both economically fair and politically popular.

Notably, the president’s comments appear to diverge from earlier statements by senior economic officials. Late last year, the Treasury secretary publicly stated that legislation would be required to authorize rebate checks, emphasizing Congress’s traditional role in appropriating federal funds. That apparent contradiction has only added to uncertainty about how, or whether, the plan could be implemented.

Some lawmakers, however, have expressed openness to the idea. Over the summer, legislation was introduced that would formally establish a rebate program tied to tariff revenue. That proposal envisioned checks of at least $600 per adult and dependent child, amounting to $2,400 for a family of four. While the bill gained attention, it has not yet advanced, leaving the question of congressional buy-in unresolved.

At the center of the debate is a broader legal battle over tariff authority itself. The Supreme Court is expected to issue a ruling that could determine whether the president has the power to impose certain import taxes without explicit congressional approval. The outcome of that case could have far-reaching implications, not only for trade policy but also for the feasibility of redistributing tariff revenue directly to households.

Administration officials have repeatedly stressed that a favorable ruling is critical to economic and national security interests. They argue that the executive branch must retain flexibility to respond quickly to trade imbalances and foreign economic threats. In their view, limiting that authority would weaken the United States’ negotiating position on the global stage.

White House confidence remains high. Senior officials have suggested that the Supreme Court is unlikely to overturn a central pillar of the administration’s economic agenda, warning that doing so could create instability and disrupt existing trade arrangements. They point to past cases in which the Court declined to dismantle major federal policies, even when they were politically contentious.

Still, officials have quietly acknowledged that contingency plans are being considered. If the Court were to rule against the administration, the government would face the complex task of addressing revenue already collected through disputed tariffs. The president himself conceded that repaying importers could prove difficult, noting that unwinding the system without harming businesses or consumers would be a significant challenge.

Beyond legal questions, economists remain divided on the financial viability of tariff-funded rebates. Several independent analyses suggest that the cost of issuing checks could exceed the revenue generated by tariffs, particularly if payments are generous and broadly distributed. One prominent economic think tank modeled multiple scenarios and concluded that most designs would consume all tariff revenue—and then some—over the next two years.

Those economists warned that using tariff funds for rebates would leave little to no revenue available for other priorities, such as deficit reduction or tax relief. In effect, they argued, the rebates could cancel out the fiscal benefits of the tariffs themselves, undermining one of the administration’s core justifications for the policy.

Other analysts have offered slightly more optimistic assessments, suggesting that limiting eligibility based on income could reduce costs substantially. Under one estimate, restricting payments to individuals earning less than $80,000 per year could still result in a price tag approaching $250 billion. While that figure is lower than broader proposals, it remains a substantial fiscal commitment.

From a macroeconomic perspective, rebate checks could provide a modest boost to consumer spending. Some forecasts suggest the payments might add close to three-quarters of a percentage point to economic growth in the year they are distributed. However, economists caution that such gains would likely be temporary and could be offset by longer-term fiscal pressures.

Political realities also loom large. Congress has shown increasing reluctance to approve large spending initiatives that add to the deficit, particularly in an environment of rising interest rates and persistent debt concerns. Even lawmakers sympathetic to the rebate concept may hesitate to support a program that could worsen the nation’s fiscal outlook.

It is only midway through the discussion that the central figure behind the proposal comes fully into view: President Donald Trump. Speaking on Jan. 20, marking the first year of his second term, Trump framed the rebate idea as both a reward for Americans and a symbol of his administration’s trade-first economic strategy. Standing before reporters, he emphasized that tariffs had transformed trade policy into a revenue-generating tool rather than merely a bargaining chip.

Trump’s remarks came as federal tariff income surpassed $101 billion for the current fiscal year, according to Treasury Department data. That figure has been repeatedly cited by the administration as evidence that its trade policies are paying dividends—literally and figuratively. Trump has argued that returning some of that money to taxpayers would reinforce public support for tariffs while easing economic pressures on households.

At the same time, Trump has tied the rebate concept to his broader goal of reducing the national debt, which now stands at roughly $39 trillion. He has suggested that tariff revenue could serve a dual purpose: providing immediate relief to Americans while helping to pay down long-term obligations. Critics counter that distributing the funds would make debt reduction less likely, not more.

As the administration continues to float the idea, uncertainty remains over the mechanics. It is unclear which agency would administer the payments, how eligibility would be verified, or how disputes would be resolved. Questions also persist about whether importers, consumers, or taxpayers ultimately bear the cost of tariffs—and whether rebate checks truly return money to the same people who paid higher prices as a result.

For now, the proposal exists in a gray area between political messaging and policy reality. Supporters see it as an innovative way to share the benefits of aggressive trade enforcement. Skeptics view it as legally questionable and fiscally risky, particularly without clear congressional authorization.

Whether the plan moves forward may ultimately depend on two factors beyond the president’s control: the Supreme Court’s ruling on tariff authority and Congress’s willingness to either endorse or challenge executive action. Until then, the idea of tariff-funded rebate checks remains a powerful talking point—and a flashpoint in the ongoing debate over the balance of power in Washington.

Emily Johnson is a critically acclaimed essayist and novelist known for her thought-provoking works centered on feminism, women’s rights, and modern relationships. Born and raised in Portland, Oregon, Emily grew up with a deep love of books, often spending her afternoons at her local library. She went on to study literature and gender studies at UCLA, where she became deeply involved in activism and began publishing essays in campus journals. Her debut essay collection, Voices Unbound, struck a chord with readers nationwide for its fearless exploration of gender dynamics, identity, and the challenges faced by women in contemporary society. Emily later transitioned into fiction, writing novels that balance compelling storytelling with social commentary. Her protagonists are often strong, multidimensional women navigating love, ambition, and the struggles of everyday life, making her a favorite among readers who crave authentic, relatable narratives. Critics praise her ability to merge personal intimacy with universal themes. Off the page, Emily is an advocate for women in publishing, leading workshops that encourage young female writers to embrace their voices. She lives in Seattle with her partner and two rescue cats, where she continues to write, teach, and inspire a new generation of storytellers.