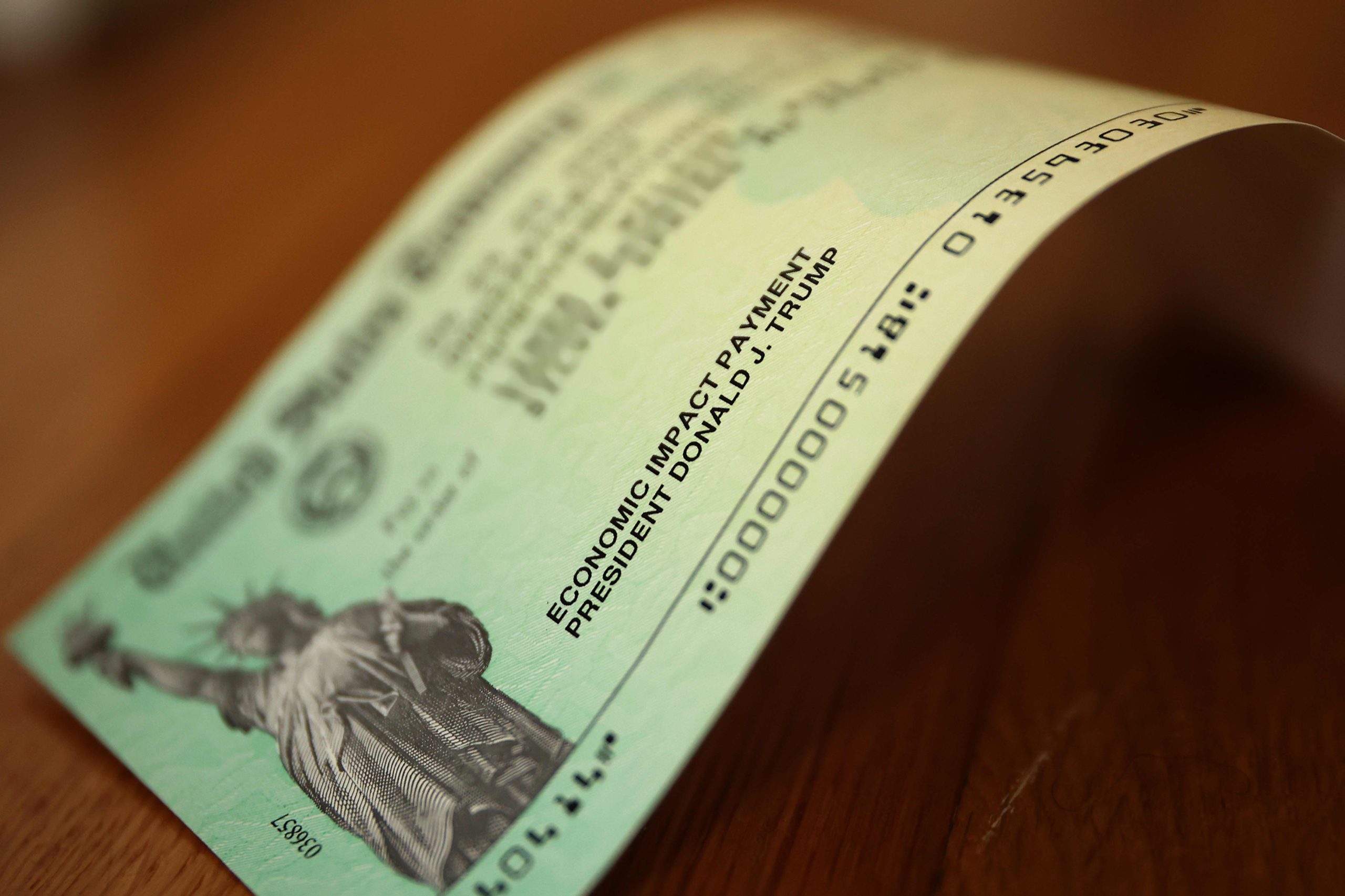

The Trump administration is reportedly moving closer to sending $2,000 tariff rebate checks to eligible Americans, with a formal proposal expected to be brought to Congress in 2026, according to a senior White House economic official.

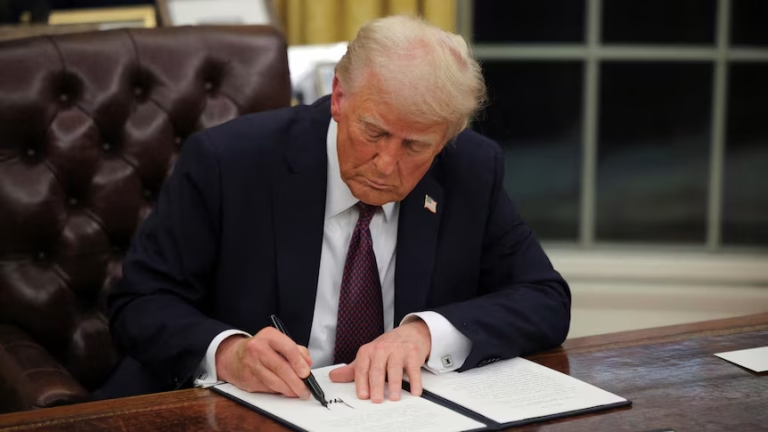

Kevin Hassett, director of the National Economic Council, indicated in an interview with CBS’s Face the Nation on December 21 that the conditions for issuing the rebates are increasingly favorable. “In the summer, I wasn’t so sure that there was space for a check like that, but now I’m pretty sure that there is,” Hassett said. He cited sustained economic growth and a reduction in government debt as the principal factors creating the fiscal room to deliver the rebate payments.

The proposed rebates, if approved by Congress, would target low- and middle-income Americans, providing a direct financial boost tied to the administration’s broader economic strategy. “I would expect that in the new year, the president will bring forth a proposal to Congress to make that happen,” Hassett added, emphasizing that Congressional approval is a prerequisite before any funds can be distributed.

President Donald Trump, Treasury Secretary Scott Bessent, and other senior administration officials have publicly discussed the $2,000 payments in recent weeks. While the idea has garnered attention among supporters, several Republican lawmakers have expressed concerns, arguing that tariff revenues might be better used to reduce the national debt rather than fund direct payments. These discussions are shaping the political landscape for the potential legislative proposal.

The rebate proposal is linked to tariffs imposed under the International Emergency Economic Powers Act (IEEPA) of 1977. The Trump administration’s tariff program has faced legal challenges, with two lower courts ruling against certain aspects of the policy. The case is now before the Supreme Court, which has the power to significantly influence the administration’s approach to tariff collections and rebate distributions.

Hassett addressed these challenges, noting that a Supreme Court decision against the administration would create what he described as “administrative problems” for issuing refunds. “We really expect the Supreme Court is going to find with us,” he said, expressing confidence in the legal framework supporting the tariffs. Even in the event of an unfavorable ruling, Hassett suggested that widespread refunds to consumers would be unlikely, due to the logistical complexity of reallocating collected duties. In most cases, the importers who pay tariffs are the first line of responsibility for distributing any refunds, he explained.

The administration has also emphasized that alternative mechanisms exist for implementing tariffs and ensuring the government receives owed duties. Treasury Secretary Bessent has indicated that countries facing higher U.S. tariffs can expect duties to remain in effect. At the same time, nations with pre-existing agreements with the United States are expected to honor prior commitments, regardless of any Supreme Court decisions.

In a December 7 social media post, President Trump highlighted the advantages of the current tariff implementation process under the 1977 law, describing it as “more direct, less cumbersome, and much faster.” He also noted that while the administration prefers this method, “other methods” are available if needed to achieve policy goals.

The proposed $2,000 tariff rebate checks are seen by administration officials as a tool for stimulating consumer spending while simultaneously reflecting the fiscal discipline achieved through reduced federal debt. By linking the rebates to tariff revenues, the administration hopes to reinforce the economic benefits of its trade policy, while delivering tangible relief to Americans affected by higher import costs.

If Congress approves the plan, the rebates would represent one of the largest direct-payment initiatives tied explicitly to trade measures in U.S. history. While past federal stimulus efforts have been linked to broader economic conditions or pandemic response measures, these rebates would be directly connected to the administration’s trade policy framework.

Economic analysts have noted that the proposal could have wide-ranging effects on household budgets, consumer confidence, and overall economic activity. The targeted payments are intended to reach millions of low- and middle-income Americans, helping to offset higher costs associated with tariffs on imported goods. Critics, however, argue that providing rebates from tariff revenue could create mixed incentives, potentially encouraging continued trade tensions or complicating longer-term fiscal planning.

Within the administration, discussions are ongoing regarding the precise eligibility criteria, distribution mechanisms, and timing of the rebate program. Treasury officials are reportedly reviewing options for efficiently disbursing the checks to minimize administrative hurdles and ensure timely delivery. The National Economic Council, led by Hassett, is playing a central role in coordinating the policy proposal and preparing the necessary economic justifications.

Beyond the immediate impact on consumers, the rebate proposal could have political implications. Some Republican lawmakers have expressed concern about using tariff funds for direct payments instead of debt reduction. Balancing these competing priorities will be key to securing legislative approval. At the same time, the administration sees the proposal as a way to demonstrate responsiveness to American households and reinforce the economic benefits of its trade policies.

Hassett, who has been mentioned as a potential successor to Federal Reserve Chairman Jerome Powell, also highlighted the broader economic considerations underpinning the proposal. The administration views the combination of economic growth and declining government debt as creating a “rare window” in which such direct payments are feasible without undermining fiscal stability.

The administration’s focus on tariff-based rebates reflects a broader strategy of using trade policy as a lever to support domestic economic objectives. By returning collected tariffs directly to consumers, the White House hopes to create a more visible link between policy decisions and benefits to American households. This approach contrasts with other uses of tariff revenue, such as debt repayment or funding government programs, by providing a direct and immediate financial impact on citizens.

Legal experts continue to monitor the Supreme Court case closely, as the outcome will shape both the administration’s tariff policy and the feasibility of issuing rebate checks. Even with favorable rulings, careful planning will be required to navigate the administrative complexity of disbursing funds through the federal system.

The proposal is also being closely watched by business groups and trade organizations. Some see the rebates as a way to offset potential negative effects of tariffs on U.S. consumers, while others caution that ongoing trade disputes and legal uncertainty could complicate supply chains and pricing structures.

Overall, the rebate plan represents an innovative intersection of fiscal policy, trade strategy, and consumer relief. If enacted, it could serve as a model for future direct-payment initiatives tied to targeted government revenues. As the administration prepares to bring its proposal to Congress in 2026, attention will focus on legislative negotiations, legal challenges, and the practical logistics of delivering $2,000 checks to millions of Americans.

In sum, the White House is positioning the tariff rebate initiative as a fiscally responsible, economically stimulative, and politically significant measure. By leveraging the combination of strong economic growth and declining debt, the administration aims to deliver direct benefits to American families, reinforce the impact of its trade policies, and address both consumer and political priorities. Whether Congress will approve the proposal remains uncertain, but the administration’s public statements indicate a clear commitment to moving the plan forward in the coming year.

Emily Johnson is a critically acclaimed essayist and novelist known for her thought-provoking works centered on feminism, women’s rights, and modern relationships. Born and raised in Portland, Oregon, Emily grew up with a deep love of books, often spending her afternoons at her local library. She went on to study literature and gender studies at UCLA, where she became deeply involved in activism and began publishing essays in campus journals. Her debut essay collection, Voices Unbound, struck a chord with readers nationwide for its fearless exploration of gender dynamics, identity, and the challenges faced by women in contemporary society. Emily later transitioned into fiction, writing novels that balance compelling storytelling with social commentary. Her protagonists are often strong, multidimensional women navigating love, ambition, and the struggles of everyday life, making her a favorite among readers who crave authentic, relatable narratives. Critics praise her ability to merge personal intimacy with universal themes. Off the page, Emily is an advocate for women in publishing, leading workshops that encourage young female writers to embrace their voices. She lives in Seattle with her partner and two rescue cats, where she continues to write, teach, and inspire a new generation of storytellers.