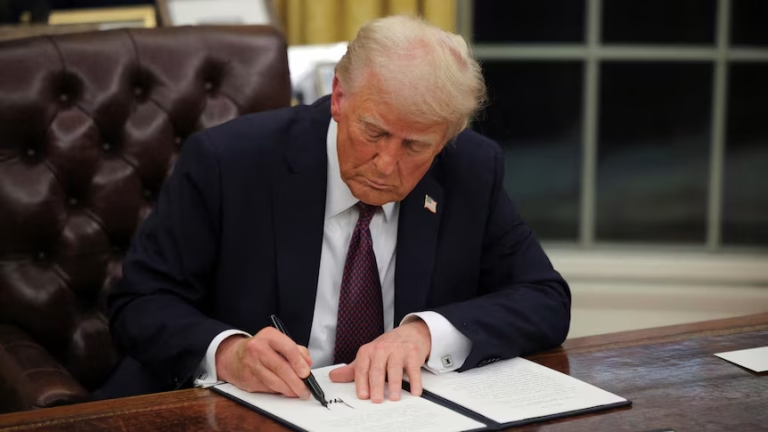

President Donald Trump has ignited national debate once again — this time with a bold pledge to deliver what he calls “tariff dividends” worth at least $2,000 to millions of lower- and middle-income Americans. The promise has generated a flood of questions from households across the country, all centered on one issue: Who qualifies, and when will checks go out?

In a time of high prices, global instability, and ongoing friction with foreign trading partners, Trump is betting that a direct payout tied to the success of his tariff policies will resonate. And for many Americans, the idea of a guaranteed $2,000 check has already captured their attention.

But despite public excitement, the mechanics of the plan remain largely unclear — and even senior officials inside the administration admit that significant legislative hurdles stand in the way. That makes Trump’s repeated assurance of a mid-2026 payout both politically potent and logistically uncertain.

Still, the president insists relief is coming. And now, for the first time, experts are zeroing in on the one simple criteria that may determine who actually qualifies.

A Promise Built on Trump’s Tariff Strategy

Trump has never been shy about tariffs. From the first days of his administration, he placed steep duties on a range of imports — especially from China — arguing that foreign competitors were exploiting American markets while hollowing out domestic industry.

Those taxes, he says, have generated “hundreds of billions of dollars” in tariff revenue. Now he wants to transform that revenue into direct payouts to working families, effectively turning his trade war into a financial benefit for everyday Americans.

“We’re going to be issuing dividends,” Trump said this month, reiterating the promise during several speeches. He suggested payments could arrive “by the middle of next year, or a little bit later than that.”

But the timeline isn’t the only thing voters want clarified. The bigger, more immediate question is whether they’ll actually meet the threshold to receive the payment.

The Only Requirement That Seems to Matter

Trump’s announcement didn’t include formal eligibility rules. No legislation has yet been introduced. No Treasury guidance has been released. And no official White House memo outlines the exact criteria.

That vacuum has led to speculation. But one well-known Social Security commentator, the YouTube analyst known as Blind to Billionaire, has offered the simplest explanation based on previous federal programs.

According to him, income — and income alone — is likely to determine eligibility.

He spelled it out clearly:

“Is your income below $75,000 a year as an individual — yes or no? That’s it. That’s all you need to know. If your answer is yes, you are most likely eligible for this.”

That threshold mirrors past government eligibility rules — including Trump’s own 2020 pandemic stimulus checks.

He further noted that, based on precedent:

-

Individuals earning under $75,000 could qualify

-

Married couples earning under $150,000 would likely be eligible

The logic is straightforward: if the tariff dividends are intended to ease financial pressure on lower- and middle-income Americans, then the income limits will likely resemble previous relief programs.

Still, without official guidance from the Treasury or the White House, the numbers remain educated estimates. But among experts, that estimate is quickly becoming the consensus.

The Big Question: Will These Checks Actually Arrive?

Even as Americans pore over their tax returns and household income numbers, a sobering reality remains: the payout is far from guaranteed.

Treasury Secretary Scott Bessent appeared on Fox Business recently and offered a cautious, even skeptical assessment. When asked point-blank whether the tariff dividend program will happen, he responded:

“We will see.”

Bessent noted that any such payout would require new legislation, meaning the White House cannot implement the plan unilaterally. Congress — which remains closely divided — would have to approve one of the largest direct-payment programs in recent history.

He also hinted that Trump’s earlier statements about a $75,000 income cutoff may not be final. In fact, he floated $100,000 as a possible upper limit for families.

The Treasury Secretary’s comments were diplomatic but unmistakably cautious. His tone suggested a program still in development, not one ready for immediate rollout.

The Massive Price Tag: Up to $600 Billion a Year

If Congress approves it, the tariff dividend would become one of the most expensive recurring cash-transfer programs in U.S. history. The Committee for a Responsible Federal Budget estimates the total cost could reach $600 billion annually.

That figure presents a stark problem: the U.S. only collects roughly $300 billion per year in tariffs.

The math is simple — and unforgiving. The program would cost twice as much as the revenue intended to fund it.

To fill the gap, lawmakers would need to approve additional spending, borrow money, or pair the proposal with deep cuts elsewhere. And with a national debt now surpassing $2 trillion, many in Congress are already pressing for spending reductions, not new commitments.

That fiscal pressure could make the tariff dividend a tough sell, even among some Republicans.

A House Divided

The fight over the tariff dividend is likely to unfold in a deeply polarized Capitol Hill. The House of Representatives remains razor-thin in its split, and both parties are already eyeing the 2026 midterms.

Some Republicans strongly back Trump’s plan, viewing it as both good economics and strong politics — an opportunity to help families directly while highlighting Trump’s trade-war revenue.

Others privately express concern about the cost. Meanwhile, Democrats may be hesitant to hand Trump a major political victory by approving checks that would arrive during an election cycle.

That means the president may need to negotiate, pressure, and rally support across multiple factions to get the legislation passed in time to meet his self-imposed deadline.

What Americans Are Really Asking

At town halls, on talk radio, and across social media, voters keep repeating the same question:

“When will I get my $2,000?”

The honest answer is: not yet — and not guaranteed.

But Trump is clearly framing the payout as part of his larger economic vision, positioning it as a reward for Americans who stood by his trade strategy through years of tariffs and market turbulence. He’s betting that voters will see the dividends as a long-awaited payoff.

With a potential mid-2026 distribution date, the timeline lines up squarely with the political calendar, giving the White House both an incentive and a challenge: deliver the checks, or risk disappointing millions of hopeful Americans.

The Bottom Line: One Rule, Big Questions, High Stakes

As of now, the best indicator of eligibility for Trump’s proposed tariff dividend is income, with the under-$75,000 threshold emerging as the primary cutoff for individuals.

But whether those checks will actually land in mailboxes is still uncertain. The cost is immense, congressional approval is far from guaranteed, and Treasury officials continue to hedge their statements.

Even so, Trump is reaffirming the idea with growing confidence — signaling to millions of Americans that relief is coming.

Whether Congress agrees is the next battle.

James Jenkins is a celebrated Pulitzer Prize-winning author whose work has reshaped the way readers think about social justice and human rights in America. Raised in Atlanta, Georgia, James grew up in a community that instilled in him both resilience and a strong sense of responsibility toward others. After studying political science and creative writing at Howard University, he worked as a journalist covering civil rights issues before dedicating himself fully to fiction. His novels are known for their sharp, empathetic portraits of marginalized communities and for weaving personal stories with broader political realities. Jenkins’s breakout novel, Shadows of Freedom, won national acclaim for its unflinching look at systemic inequality, while his more recent works explore themes of identity, resilience, and the fight for dignity in the face of oppression. Beyond his novels, James is an active public speaker, lecturing at universities and participating in nonprofit initiatives that support literacy and community empowerment. He believes that storytelling is a way to preserve history and inspire change. When not writing, James enjoys jazz music, mentoring young writers, and traveling with his family to explore cultures and stories around the world.